BKash’s Bet on Customer Acquisition has Paid Off in 20204 min read

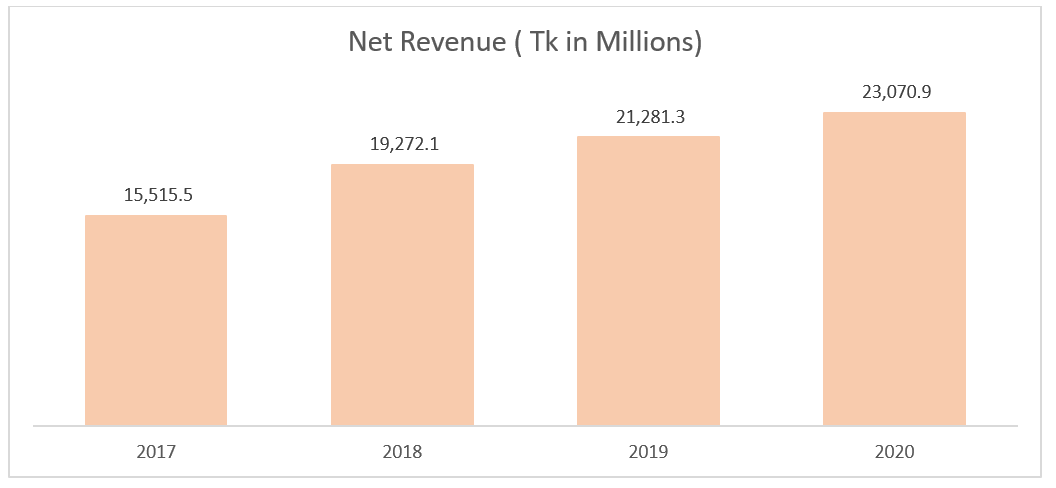

Bkash, the leading MFS provider in Bangladesh has published its financial statement for the year ending in 2020. The company’s net revenue grew by 8.4% YoY mainly driven by growth in Cash out & Return on trust cum settlement accounts. The net revenue in 2020 was Tk 23,071 million which was Tk 21,281 million in 2019. Bkash’s profit declined by 7.9% YoY mainly due to an increase in agent and distributor commission, commercial outlay & technology expenses to support the early investment and growth stage of the company.

Customer Acquisition

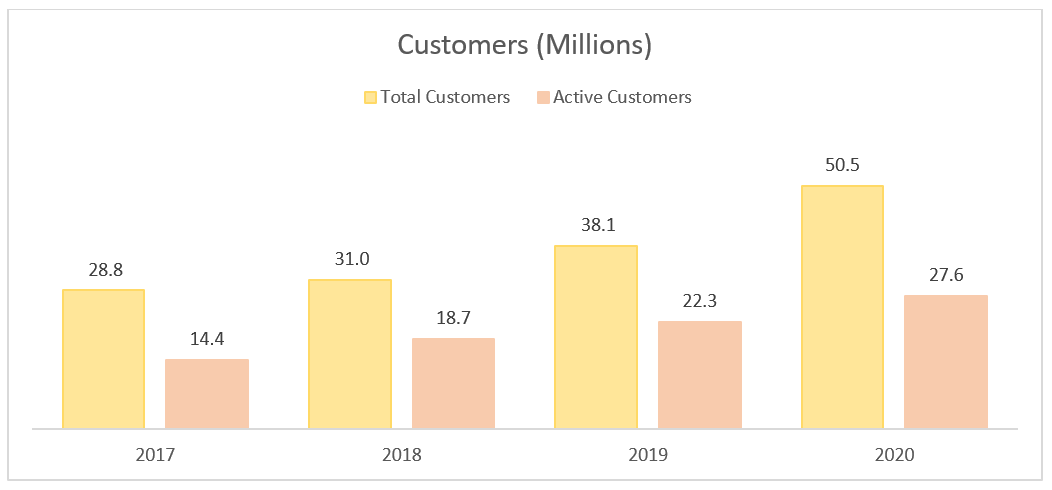

In terms of customer acquisition, Bkash had one of the best years in the last few years by acquiring about 12.4 million customers in 2020. The customer acquisition growth was 32.5% YoY which has been the highest growth since 2017. The growth is mainly due to Bkash’s relentless focus on acquiring customers and the coronavirus pandemic which increased reliance on MFS transactions.

Read more: Olympic Industries Ltd’s Sales Grew By 11.2% In Q3’20-21

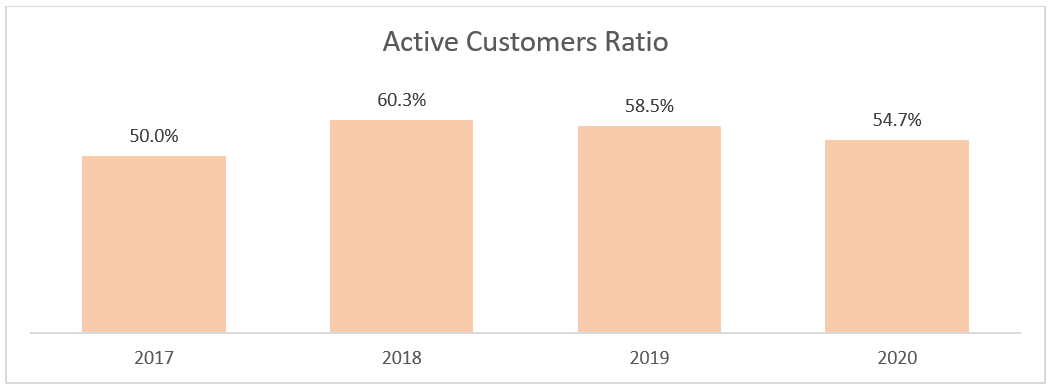

The company also succeeded in terms of active customer acquisition. Active customers (customer who transacted at least once in the last 90 days) has grown by 23.8% YoY from 22.3 million in 2019 to 27.6 million in 2020. The active customer ratio stood at 54.7% which was 58.5% in 2019.

The company has also seen significant user growth in 2020. In 2020, the number of App users was 7.1 million compared to 4 million in 2019. The user grew by 77.5% YoY. The growth in app users is mainly due to Bkash’s focus on introducing new services like the ability to pay utility bills, credit card payments, etc.

Revenue Analysis

The company’s net revenue grew by 8.4% YoY mainly driven by growth in Cash out & Return on trust cum settlement accounts. The net revenue in 2020 was Tk 23,071 million which was Tk 21,281 million in 2019.

The growth in net revenue is mainly attributed to the coronavirus pandemic situation which forced people to use MFS to transfer money. Due to the pandemic, the MFS industry saw a boom in transaction volume since a lot of the factory workers were paid using MFS transactions & a lot of people started using MFS payments which is a safer alternative of transaction in this situation.

Bkash also saw a huge surge in transaction volume in 2020. The transaction volume in 2020 was BDT 430+ billion which is a 29% YoY growth compared to 2019. The peer-to-Peer transaction also grew by 82% YoY.

Read more: Unilever’s Sales Grew By 13.8% in Q1’21

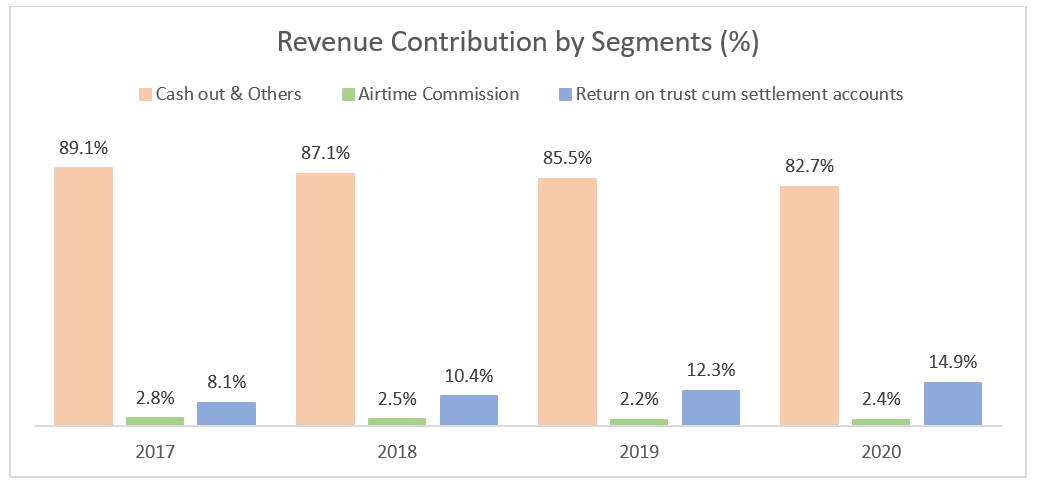

Reliance on Cash out revenue is gradually decreasing due to Bkash’s focus on introducing different services like airtime, utility & merchant payment through its app. Cash-out contributed to 82.7% of the total net revenue in 2020 which was 89.1% in 2017.

Return on trust cum settlement accounts contribution increased from 12.3% in 2019 to 14.9% in 2020 mainly due to the company’s prudent investment in FDR and Government Securities using its float balance.

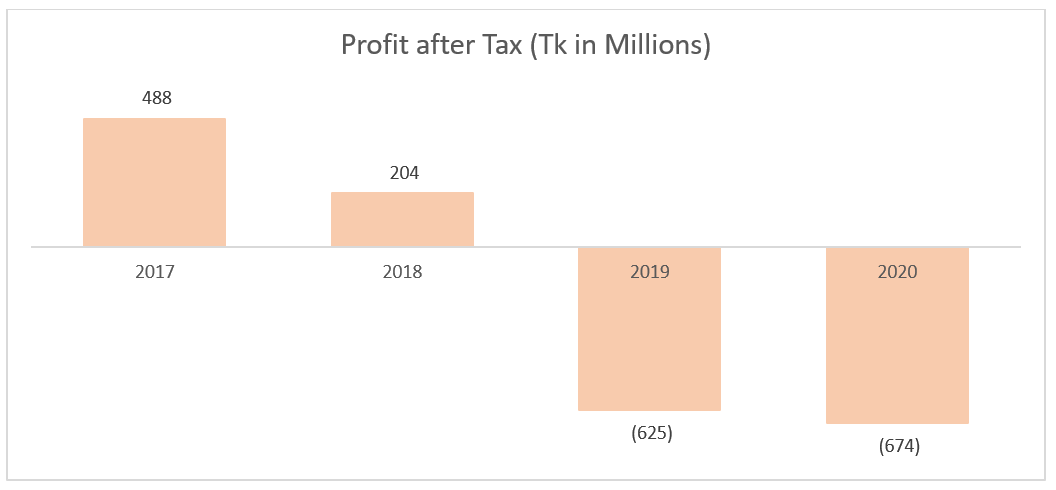

Profit Analysis

Profit of the company further declined by 7.9% mainly due to an increase in agent and distributor commission, commercial outlay & technology expenses to support the early investment and growth stage of the company. Operating & Administrative expenses increased by 22.5% YoY and Commercial expenses increased by 20.2% YoY.

The growth in expense is largely due to the focus of the company in increasing its customer base by investing in technology and marketing. Software and other maintenance expense increased from Tk 570.3 million in 2019 to Tk 766.2 million in 2020. The company also invested heavily in the campaign. Campaign charges were Tk 1,070.6 million in 2020 which was Tk 464 million in 2019.

Future Ahead

In 2020, Bkash mainly focused on increasing its customer base and services so that Bkash doesn’t become just a cash-in and cash-out service. By the analysis, it can be said that Bkash has successfully succeeded in its objective since they had an outstanding year in terms of customer acquisition and also the reliance on cash-out revenue is decreasing every year. Even the growth in peer-to-peer transactions is one of the best achievements in 2020. Although profit is the main benchmark for every company but for a growth stage company like Bkash its performance KPIs like customer acquisition, transaction volume matter more. Hence it can be said that 2020 was a successful year for Bkash. The company is expected to grow more in 2021 since the second wave of coronavirus might again increase the reliance on MFS transactions.

Source

For more updates, be with Markedium.