The Growing Supply Chain Finance Market of Bangladesh4 min read

Supply chain finance is getting popular in Bangladesh with its demand growing among large corporates. According to Investopedia, supply chain finance is a financing solution that aims to lower financing costs and improve business efficiency for buyers and sellers in a transaction. Under this financing structure, the buyers agree to approve their suppliers’ invoices for financing by a bank or NFBI. Often the term is also known as factoring. Usually, supply chain finance is of two types: Factoring and Reverse factoring.

Factoring is a financing solution where the bank or NBFI provides financing to the supplier by purchasing its account receivables. Reverse factoring is a financing solution where large corporates offer early payments based on approved finances.

Impact of Supply Chain Finance on SMEs

Supply Chain finance can be an essential financial instrument for Small and Medium Enterprises (SMEs) which work with large corporations. Usually, the working capital needed for SMEs is high as the companies have low paid-up capital compared to the large corporations. While working with large corporations, the SMEs need to provide longer credit terms which might affect their working capital needs. Hence, supply chain finance works as a bridge between large corporations and suppliers. Through the financial solution, SMEs can receive early payments on their invoices. Supply chain finance allows SMEs to optimize both parties’ working capital and liquidity.

Read more: The Automotive Industry Outlook of Bangladesh

The structure of the supply chain finance allows the financial institutions to offer lower financing costs to the suppliers based on their credit rating. The supplier also is benefitted by receiving the payment early, deducting the fee, which is lower than the cost of traditional loans in terms of early settlement. As a result, the SMEs or the suppliers get the opportunity to use the payments for their working capital needs.

Supply Chain Finance Market of Bangladesh

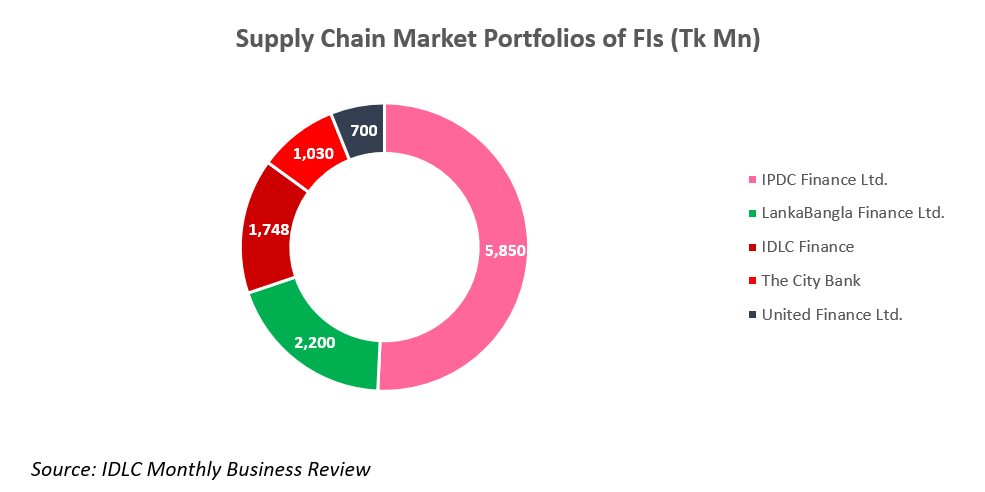

According to IDLC Monthly Business Review, the total market size of the supply chain finance market is approximately Tk 4,000 crore, including the banks and NBFIs. The supply chain finance market is still in the nascent stage and has the potential to grow exponentially. The current market size is very low due to the lack of penetration of financial institutions.

Supply chain finance is very popular in neighboring countries like India and Sri Lanka, and the market is expected to grow in Bangladesh if it is backed with policy backups and proper monitoring. Factoring is the most popular form of supply chain finance in Bangladesh however, reverse factoring is not that widespread in Bangladesh. According to the report, supply chain finance has the potential to become a cash cow as there is a huge number of Small and Medium Enterprises (SMEs) in Bangladesh.

Read more: MFS Industry Of Bangladesh: Bringing Easy Access To Finance To Many

IDLC Finance Ltd first introduced supply chain finance in 1999. Then in 2006, United Finance and LankaBangla Finance Limited entered the market. IPDC Finance entered the supply chain market late but is now the market leader in this segment.

It can be seen from the above graph that IPDC Finance is way ahead of its competitors with a Tk 5,850.0 Mn portfolio in this segment. LankaBangla sits in the second position with Tk 2,200 Mn portfolio size.

Read more: Case Study_ IKEA Style for All

IPDC Finance is the leading financial institution in this segment as the company continuously innovates to serve the market. One of the most renowned innovations by the company in this segment is IPDC Orjon. Orjon is South Asia’s first blockchain-based digital supply chain finance platform developed by IPDC Finance in partnership with IBM. The platform aims for the financial inclusion of MSMEs by providing easy access to collateral-free, low-cost credit in the form of Supply Chain Finance in collaboration with corporate bodies through creating an ecosystem for end-to-end supply chain management. The project has been awarded the Best Innovation – Finance – NBFIs in the Bangladesh Innovation Awards 2021. The company is also launching Dana, the company’s first retailer finance platform in the supply chain finance segment.

Conclusion

According to the SME Foundation, there are about 7.8 million SMEs in the country. As a result, the supply chain finance market has immense potential as SMEs are the driving force in employment generation in our country.