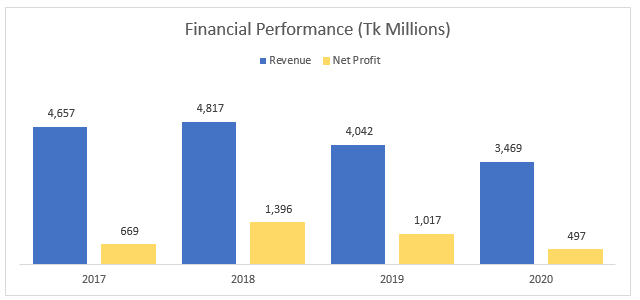

Unilever Consumer Care Limited (formerly known as GlaxoSmithKline Bangladesh Limited) has recently published its annual report for the year 2020. The total revenue of the company has declined by 14.2% YoY from Tk 4,042 million in 2019 to Tk 3,469 million in 2020. Net Profit has decreased by 51.1% YoY mainly due to Covid-19 which reduced not only the consumer demand but also disrupted the global supply chain.

Revenue Analysis

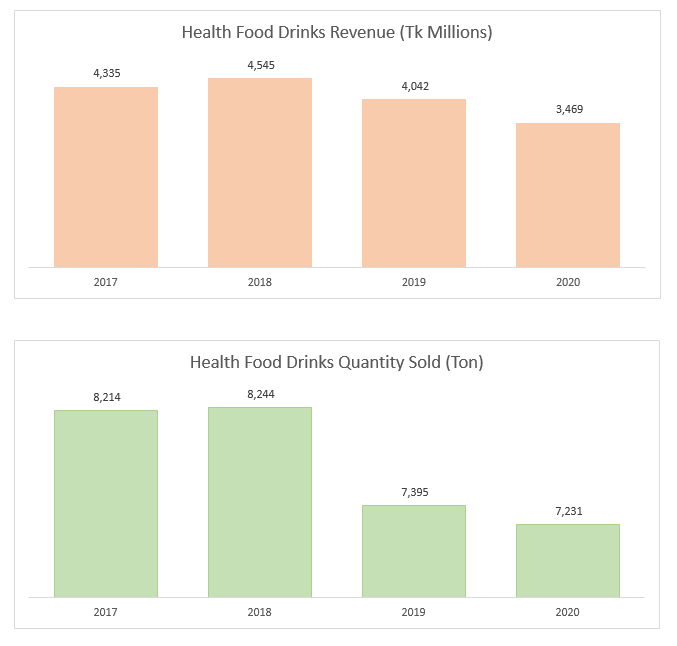

Covid-19 had a huge impact on the first six months of the financial year. First, consumer demand decreased due to the diminishing purchase period during the 2 months lockdown from March 20-June’20. Second, the global supply chain was disrupted for which the company was unable to import sufficient DMI (Dry Mix Ingredient) and other materials for Health Food Drink production.

Moreover, the company also decided to reduce the price of its most popular brand Horlicks for which revenue declined by 14.1% but the quantity sold only declined by 2.2%. Unilever launched a 500g value pack at an affordable price to reach more low-income groups. It clearly indicates is trying to reach the mass market with its Health Food Drinks.

Profit Analysis

Profit declined by 51.1% mainly due to low sales achievement as well as lower profit margin. The profit margin of the company was 25% in 2019 which declined to 14% in 2020.

Read More: Grameenphone Q1’2021 Performance Review

The decline in margin is mainly due to an increase in DMI (Dry Mix Ingredient) duty from 15% to 25% & price inflation on key raw materials due to supply chain disruption. Since Unilever is reliant heavily on imports to produce Health Food Drinks it is not surprising that the company was adversely affected by the global pandemic.

Future Ahead

The acquisition of the Health Food Drinks segment which includes brands like Horlicks, Boost, Maltova, and Glaxcose D from GlaxoSmithKline Bangladesh Limited has a lot of synergies for Unilever. Unilever is a dominant player in the consumer market in Bangladesh and the strong distribution network of the company will only help the Health Food Drinks segment to grow in the future. However, in the near term, the company will face difficulties due to the second phase of the Covid-19 pandemic. So, it is expected if the second phase prolongs then it will have an adverse impact on the revenue & profit of the company.

Source: Unilever Consumer Care Limited Annual Report 2020

For more updates, be with Markedium.

[newsletter-pack newsletter=”5159″ style=”default” si_style=”default” title=”” show_title=”0″ icon=”” heading_color=”” heading_style=”default” title_link=”” custom-css-class=”” custom-id=””][/newsletter-pack]

Leave a comment