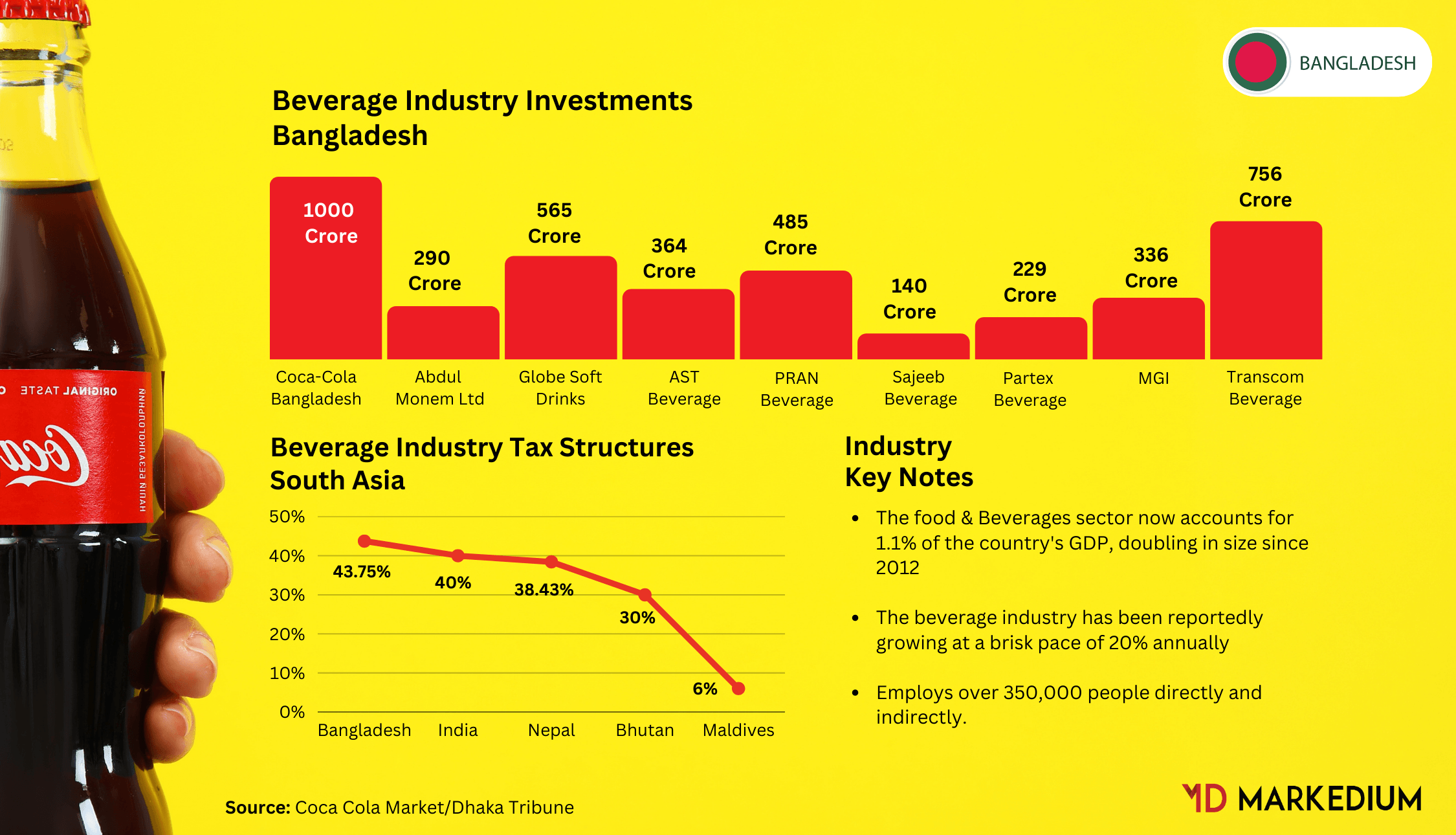

The beverage industry in Bangladesh has shown a meteoric rise over the past decade, with the Food & Beverage sector now accounting for 1.1% of the country’s GDP, doubling in size since 2012. The growth potential is truly immense, as Bangladesh is currently enjoying a multi-decade demographic dividend phase, leading to a surge in consumer demand for “Ready to Drink” beverages. As a result, the beverage industry has been reportedly growing at a brisk pace of 20% annually, a trend expected to continue given the low penetration and consumption levels in the country.

With the industry providing employment to about 350,000 people, both directly and indirectly, and with a majority of its raw materials sourced locally, the beverage industry plays a significant role in supporting the local economy. Furthermore, multinational companies have poured in Foreign Direct Investment (FDI), while domestic companies also continue to invest heavily. For instance, Coca-Cola, one of the multinational players, announced in 2020 to invest $200 million in Bangladesh by 2025, & Akij Food and Beverage Ltd’s establishment of the country’s first aseptic plant to produce fruit drinks in a completely automated process at a cost of Tk300 crore states a testament to the optimistic outlook for the industry.

However, the industry now faces a potentially significant setback due to the proposed 5% turnover tax, a significant leap from the current 0.6%. This tax, alongside the existing corporate and business taxes, Supplementary Duty (SD), and VAT, could pile on the financial pressure on the industry’s players.

To put things in perspective, the combined tax rate for Carbonated Soft Drinks (CSDs) currently stands at 43.75%, higher than neighboring countries such as India (40%), Nepal (38.43%), Bhutan (30%), and Maldives (6%). If the proposed tax increase comes into effect, the companies will reportedly have to raise their product prices by 20%-30%, which could result in a drastic fall in consumption and a subsequent decrease in revenue collection.

While it’s clear that the new tax structure could have adverse impacts on the industry, it’s also essential to understand the rationale behind the government’s decision. The International Monetary Fund (IMF) has set a target for Bangladesh to increase its tax-GDP ratio from 7.8% to 8.3% by the end of FY24 and to 9.5% by the end of FY26.

This is part of the conditions of the IMF’s $4.7 billion loan package. To meet this target, the Bangladeshi government needs to raise the revenue by at least an additional Tk65,000 crore by the end of FY24, a whopping 20% increase from the ongoing fiscal year’s collection.

Read more: Recognizing Marketplace In VAT Act Is A Milestone For The E-Commerce Industry

Increasing the tax-GDP ratio could have significant benefits for the country’s economy. According to the Policy Research Institute (PRI) of Bangladesh, an increase in the tax-GDP ratio by 5 percentage points could increase economic growth by up to 3.3 percentage points and reduce the poverty headcount rate by up to 2.2 percentage points. To achieve this, the government has several options, including reducing tax exemptions, improving compliance with personal income tax and corporate tax systems, and reforming the VAT system.

With these reforms, Bangladesh is striving to balance the need for revenue increases while ensuring fairness in the system. The challenge will be to mitigate the adverse impacts on sectors like the beverage industry, which have been a significant contributor to the economy’s growth.

Read more: Berger Extends Contract With Rupali Chowdhury And Appoints New COO

In conclusion, the beverage industry in Bangladesh, which is a crucial player in the country’s economy, is at a crossroads. The proposed tax reforms could significantly affect its growth trajectory. However, these reforms are not merely external demands from the IMF, but necessary adjustments for the long-term health of the Bangladesh economy. The industry’s challenge will be to navigate these reforms while continuing to contribute to the country’s development visions and aspirations, such as Vision 2041 and the creation of a Smart Bangladesh. The beverage sector, through its investments, innovations, diversifications, and sustainability initiatives, can continue to make significant contributions to these aspirations, despite the challenges posed by the new tax regime.

Yet, the government’s role in ensuring a favorable business environment for the industry is critical. It is necessary to strike a balance between achieving fiscal targets and maintaining the momentum of growth sectors. The potential adverse impacts of the proposed tax hike, such as the possible exit of players from the industry and the discouragement of new investments, need to be carefully considered and mitigated.

The beverage industry of Bangladesh is at an inflection point. The decisions made today will determine the industry’s path for years to come. Through collective effort and strategic foresight, it is possible to align the interests of the government, the industry, and the people of Bangladesh.

Read more: From We to Me: The Fall of Adam Neumann and WeWork | Lessons for the Next-Gen Entrepreneurs

Ultimately, the goal should be to ensure the sustained growth of the beverage industry, while also achieving the larger economic objectives of the nation.

Thus, as the sun rises on a new fiscal year, the beverage industry, government, and other stakeholders must work together to ensure that the industry’s growth story continues unabated. And in doing so, they can ensure that Bangladesh’s beverage industry remains a vibrant and integral part of the country’s economy.

For more updates, be with Markedium.

Leave a comment