In the heart of South Asia, nestled between India and Myanmar, lies a country that has been quietly undergoing a financial revolution. Bangladesh, a nation of more than 160 million people, has been embracing digital finance at a remarkable pace. This transformation is not just changing the way transactions are conducted, but it’s also reshaping the entire economic landscape, fostering growth, and driving financial inclusion.

Digital finance, which encompasses a broad range of financial services delivered through digital channels, has emerged as a powerful tool to bring the unbanked into the formal financial system. As Bangladesh advances on its journey towards becoming a digital nation, a critical foundation for this transformation lies in the adoption of digital finance by its citizens. The concept of ‘Smart Citizens’ – individuals who are digitally literate and make use of technology for various aspects of their lives – is central to this evolution. These Smart Citizens are not only beneficiaries of digital financial services, but also drivers of its growth, helping to create a robust digital ecosystem.

Embracing digital finance has become a prerequisite in building a ‘Smart Bangladesh’, as it enables efficient, secure, and inclusive economic transactions, fostering financial inclusion and laying the groundwork for a digitally empowered society. By leveraging mobile financial services, online banking, and other fintech solutions, Smart Citizens are paving the way for a modern, connected, and smart Bangladesh.

Read more: Square Toiletries Limited Appoints Malik Mohammed Sayeed As The New COO

This article aims to explore the current state of digital finance adoption in Bangladesh—with a view to exploring the impact on the economy and the future of the industry as a whole.

Let’s dig deep!

Pioneering The Light of Digital Finance

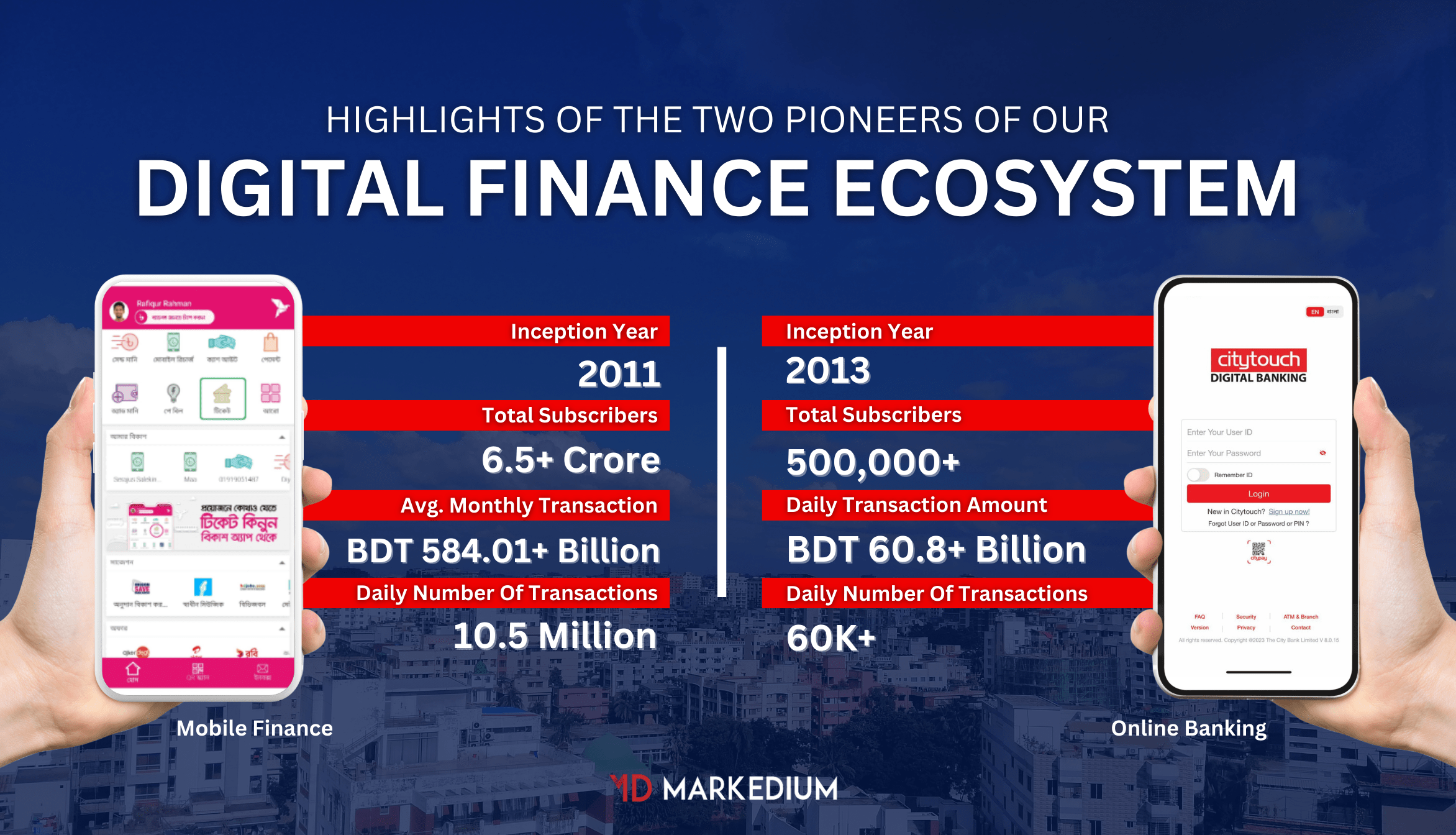

The advent of digital financial services in Bangladesh can be traced back to the pioneering efforts of two significant players – bKash and Citytouch by City Bank. The digital finance ecosystem in the country saw a new dawn with the inception of these platforms, which have since played instrumental roles in the nation’s move towards a cashless society.

bKash, launched in 2011 by BRAC Bank in collaboration with Money in Motion LLC, was the first mobile financial service (MFS) provider in Bangladesh. It aimed to ensure access to a broader range of financial services for the people of Bangladesh, particularly those who were previously unbanked or underbanked. bKash revolutionized the way people transacted money by enabling them to make payments, transfer funds, and even save money, all through a mobile device.

Building on the same digital foundation, City Bank launched Citytouch in 2013, becoming the first Bangladeshi bank to introduce a digital banking application. With Citytouch, City Bank extended its banking services to the digital platform, offering an array of services such as fund transfers, bill payments, and account inquiries. Citytouch not only enhanced the convenience of banking for existing customers but also attracted a new generation of tech-savvy clients, further fostering the country’s digital financial landscape.

The introduction of bKash and Citytouch marked the onset of the digital finance era in Bangladesh, and according to the data presented by the Bangladesh Bank, customers across the nation are increasingly embracing the digital finance ecosystem, leveraging its benefits to enhance convenience and efficiency in their daily lives. This is evident in the multitude of ways digital finance is used, spanning from increasing online banking, online shopping, and utility payments to peer-to-peer (P2P) transactions.

Let’s delve into it

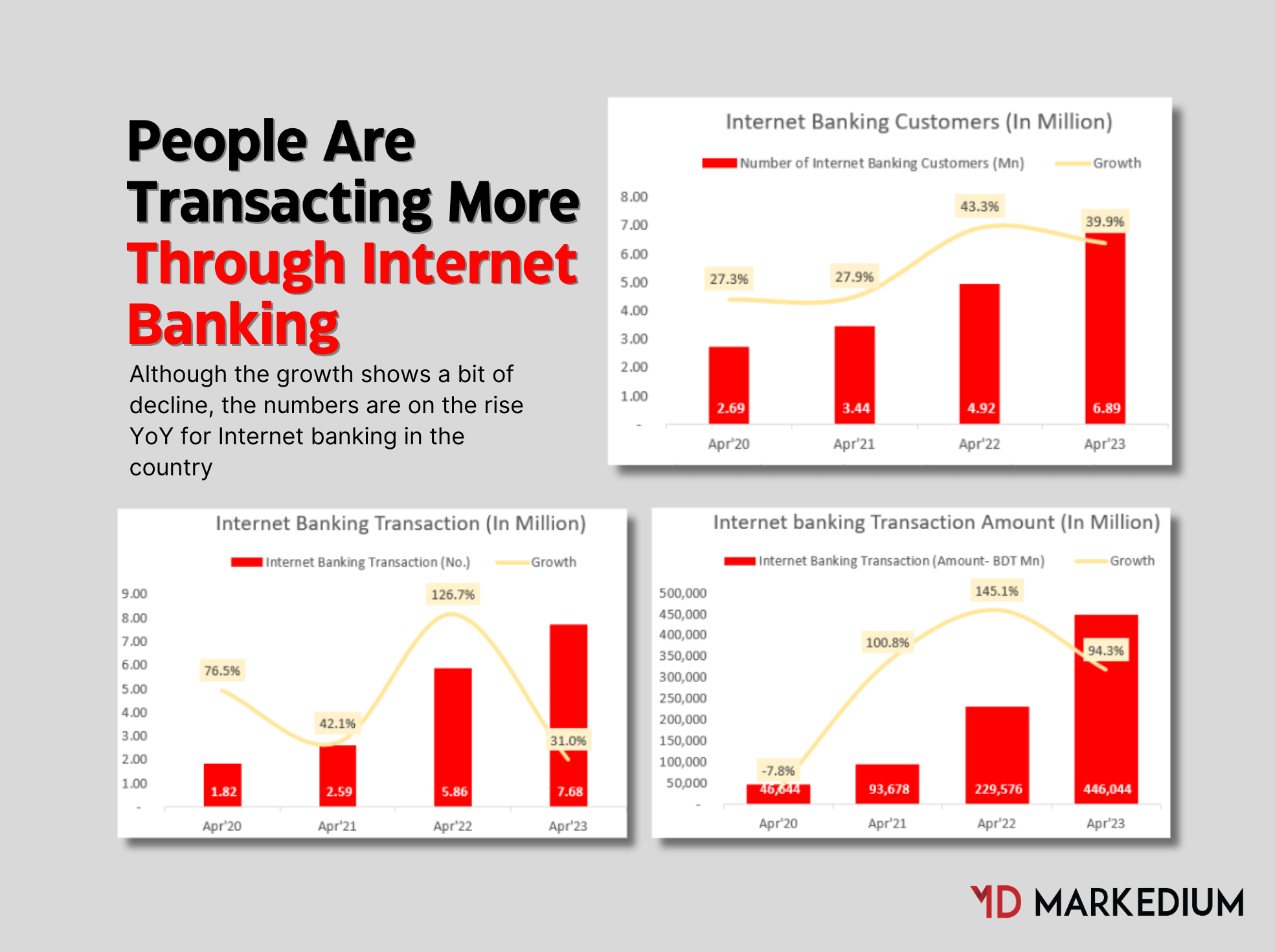

Internet Banking has seen significant growth in recent years and shown a consistent increase in numbers for all the variables indicating the acceptance of convenience in banking transactions brought by the digital finance ecosystem.

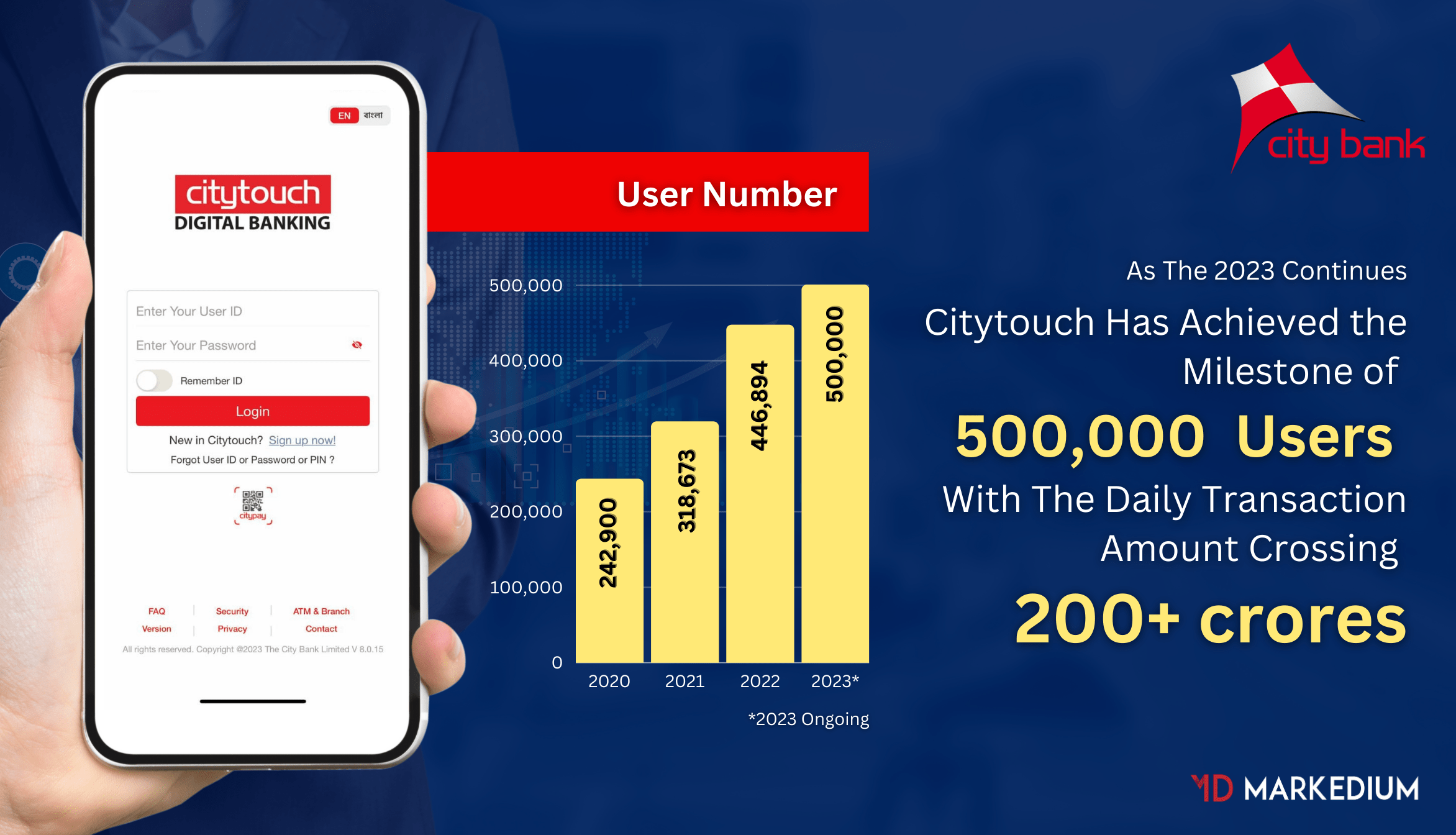

Pioneer players like Citytouch, the digital banking platform from The City Bank, have been instrumental in enhancing the adoption of Internet banking in Bangladesh. To enhance Internet transaction adoption in Bangladesh, Citytouch stepped up to provide much-needed digital solutions.

Citytouch not only brought banking tasks to the comfort of the customers’ homes but also made them doable from a smartphone. Among the many innovative solutions, the bank launched the country’s first mobile app for end-to-end account opening, City Ekhoni, enabling customers with a national ID card to set up a bank account from home1.

The bank also introduced WhatsApp banking and a mobile app for working capital finance customers, which allowed customers to access their account information and manage funds at any time, from anywhere

Read more: From We to Me: The Fall of Adam Neumann and WeWork | Lessons for the Next-Gen Entrepreneurs

Such innovations from industry players are the cornerstone of the current rising adoption of Internet banking in the country.

The growth of Citytouch over the past years is also a testament to the ongoing successful adoption of Internet banking in the country. The digital payment app of the City Bank has seen a 100% growth in transaction counts in 2022 with a 40.2% growth in user growth in the same year. As 2023 continues, the app has recently crossed the milestone of 500000 users with a daily transaction of 200+ crore.

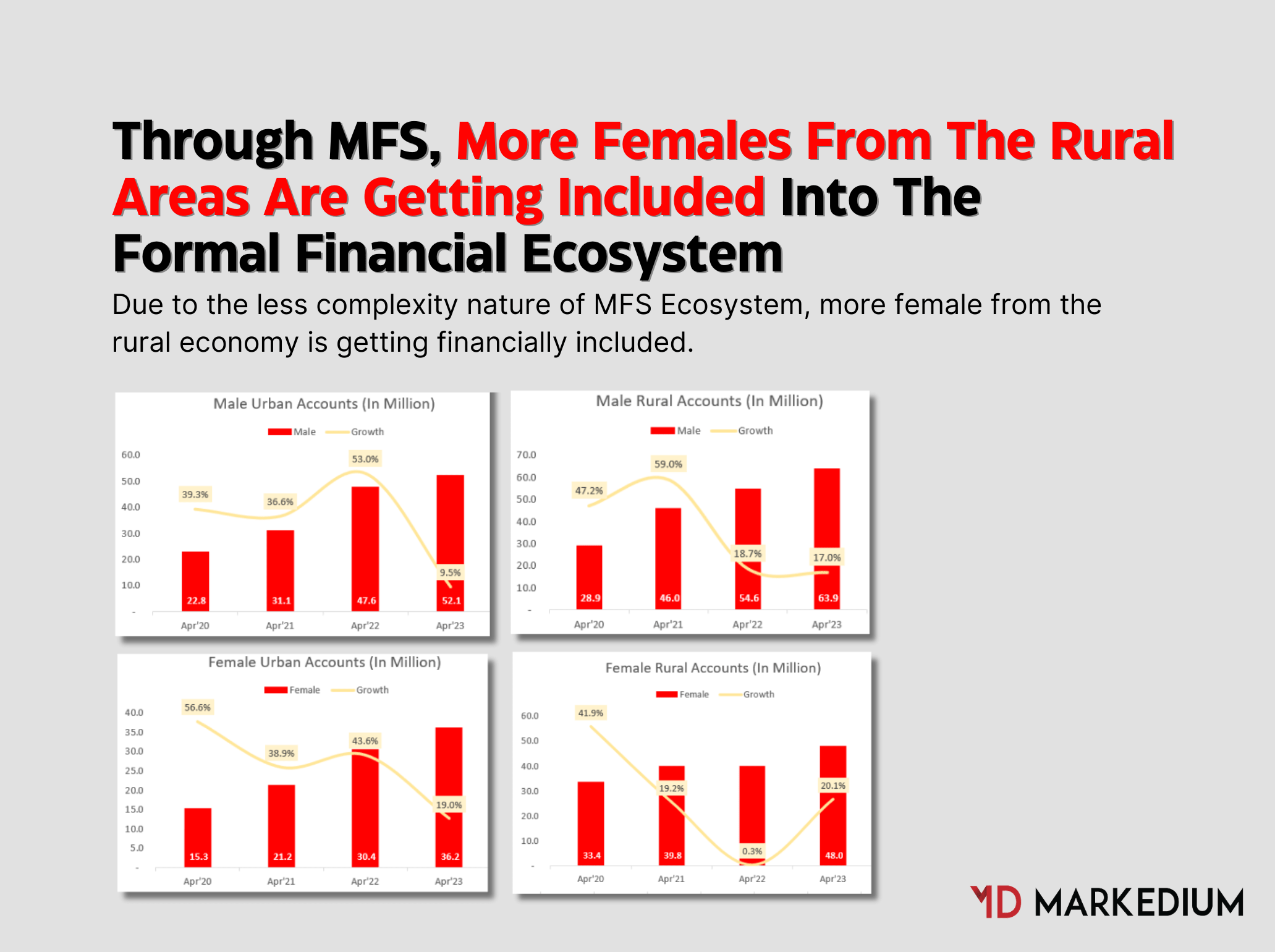

Adding on thanks to the widespread adoption of the MFS ecosystem in the country, the national population is quite consistent with the rise of adoption, thus resulting in a higher portion of the population getting included in the formal financial ecosystem. One particular sector that makes the future even more prosperous is the increasing participation of female MFS accounts from the rural areas showing a significant 20.1% growth YoY.

The COVID-19 pandemic played a significant role in accelerating the adoption of digital financial services in Bangladesh. During the early days of the pandemic, close to 300,000 MFS accounts were opened, with women accounting for more than two-thirds of these new accounts. This helped to close the country’s considerable gender gap in financial inclusion. The pandemic also triggered a shift towards digital payments in private and non-profit sectors.

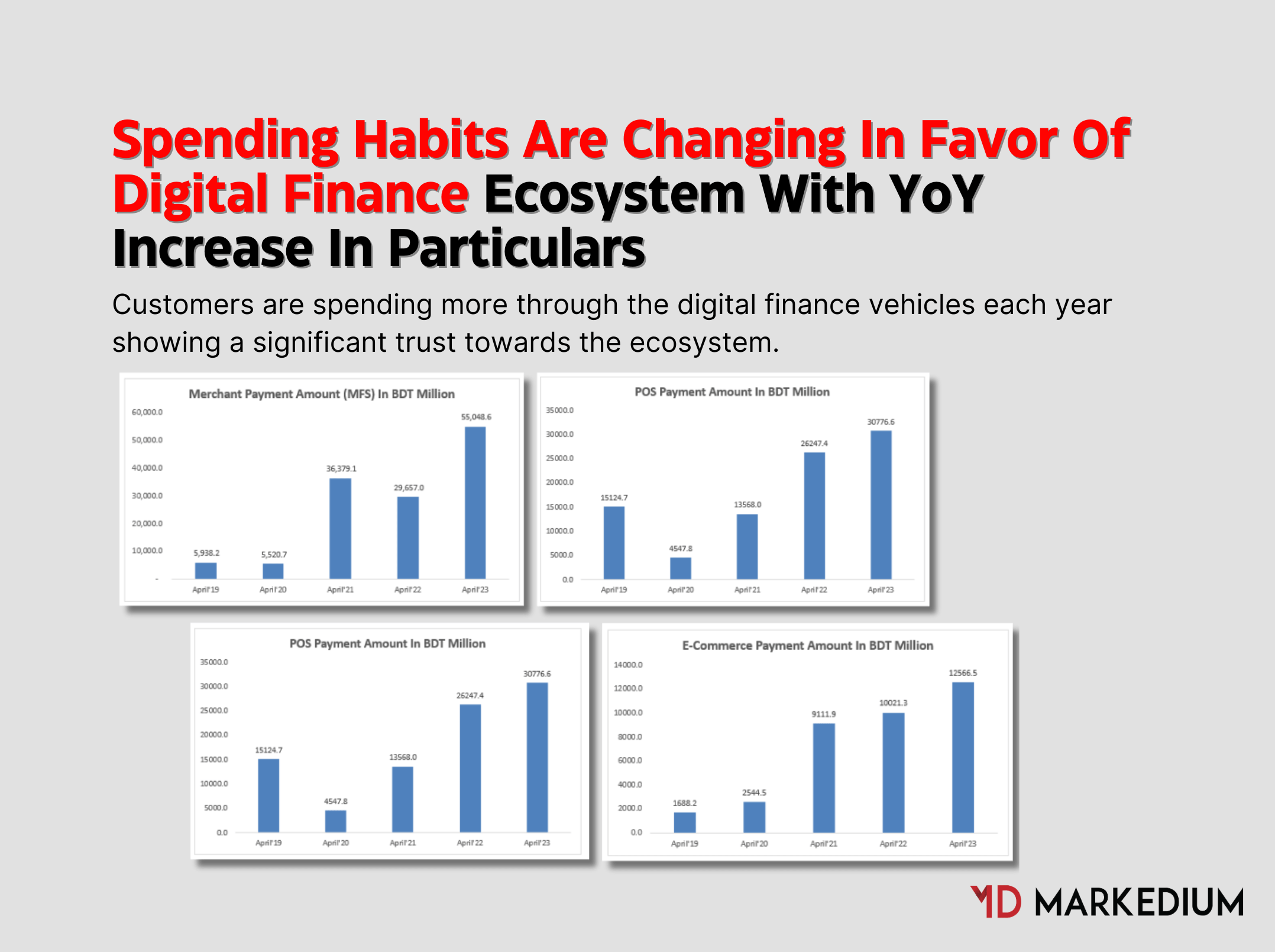

And as the data shows, the people of Bangladesh have kept on embracing the benefits of digital finance and indicating a steady change in consumer behavior from traditional finance to digital finance adoption. For instance-

The convenience of online shopping has been amplified by the adoption of digital payments, offering a seamless and secure way to purchase goods from the comfort of home. Similarly, the hassle of paying utility bills in person has been significantly reduced with digital finance, allowing customers to make payments at their convenience without any geographical or temporal constraints.

Read more: A Bitter Cup: How Starbucks Lost the Australian Coffee Battle

In the retail sector, Point of Sale (POS) payments for goods through digital means are growing in popularity, offering customers a quick, secure, and contactless method of payment. This is not just limited to large retail stores; small and medium-sized enterprises are also adopting digital payment systems, further permeating digital finance into the economy.

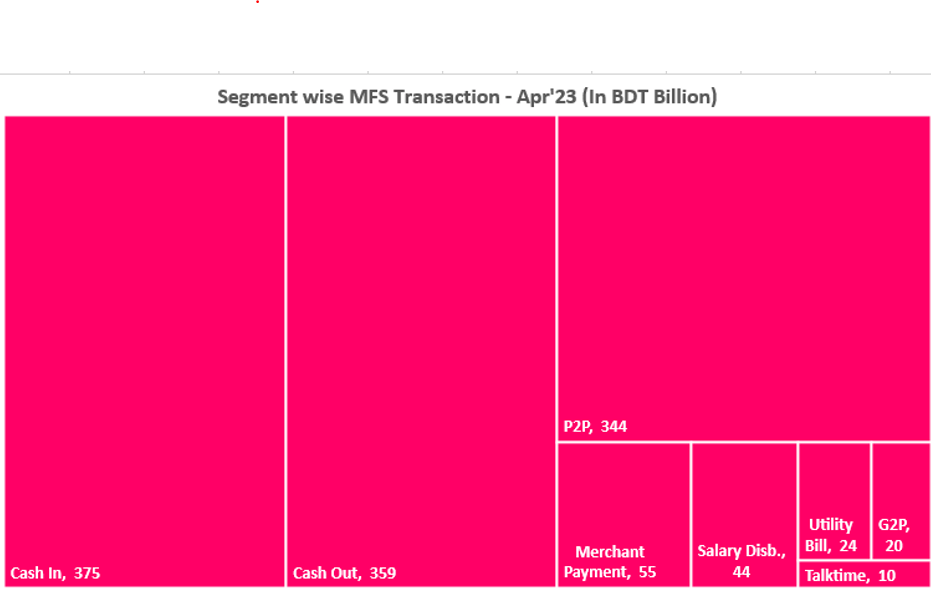

In the sphere of personal transactions, P2P services have simplified the process of sending and receiving money, making it as simple as a few taps on a smartphone. This has made remittances more accessible and efficient, especially for the unbanked and underbanked populations.

Furthermore, the practice of salary disbursement has also been revolutionized. Employers are now able to reimburse employees digitally, eliminating the need for physical cash handling and providing a safer and faster method of payment.

In particular, for the MFS industry, the higher value of the Cash-in amount than the Cash-out amount states the growing interest in using MFS as an alternative to a regular wallet and consumers’ positive attitude to the benefits of digital finance ecosystem, and the use-case particulars speaks for themselves as an exhibit for the increasing digital finance adoption in the country.

Adding on, the burgeoning digital finance landscape in Bangladesh, underpinned by groundbreaking innovative collaborations such as the one between bKash and the City Bank for digital nano loans, and the advent of digital savings capabilities through MFS players like bKash, has fundamentally altered the financial sector and enriched consumer experiences.

These cutting-edge enhancements have instituted frictionless financial transactions, streamlined traditional banking procedures, and broadened the reach of financial services, especially amongst the previously unbanked populace. The digitization wave has not only fostered an inclusive financial environment but also facilitated the launch of bespoke, consumer-centric financial products.

Consequently, it has cultivated improved financial literacy and resilience among consumers, thereby enabling them to navigate their financial futures with greater confidence and autonomy resulting in changing spending behavior in favor of the digital finance ecosystem in Bangladesh.

Read more: Data And Bundle Services Contributed To Grameenphone’s 5.1% Revenue Growth In 2022

Overall, what started with bKash and Citytouch a decade ago- the two pioneers of the digital finance ecosystem in Bangladesh roughly a decade ago, the current adoption of digital finance by customers in Bangladesh is not just showing a trend, but a testament to the nation’s digital transformation.

It signals a move towards a more efficient, inclusive, and resilient financial system, paving the way for a brighter, digitally empowered future with smart citizens becoming the pillars of a smart Bangladesh.

For more updates, be with Markedium.

Leave a comment