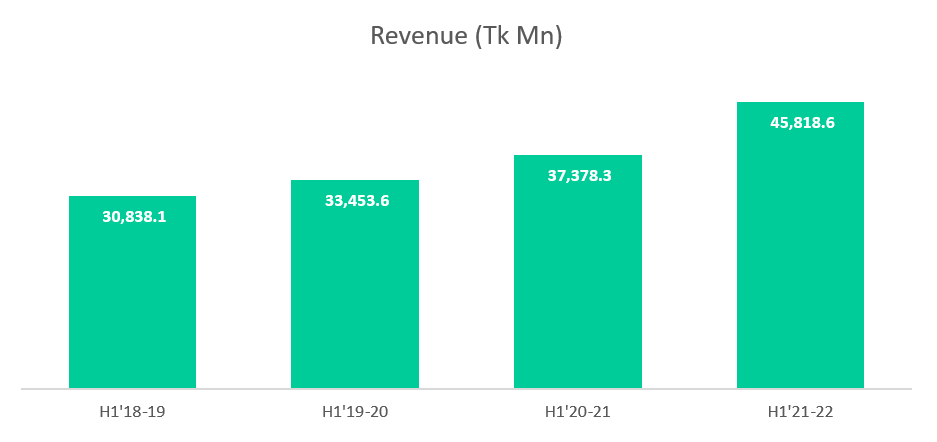

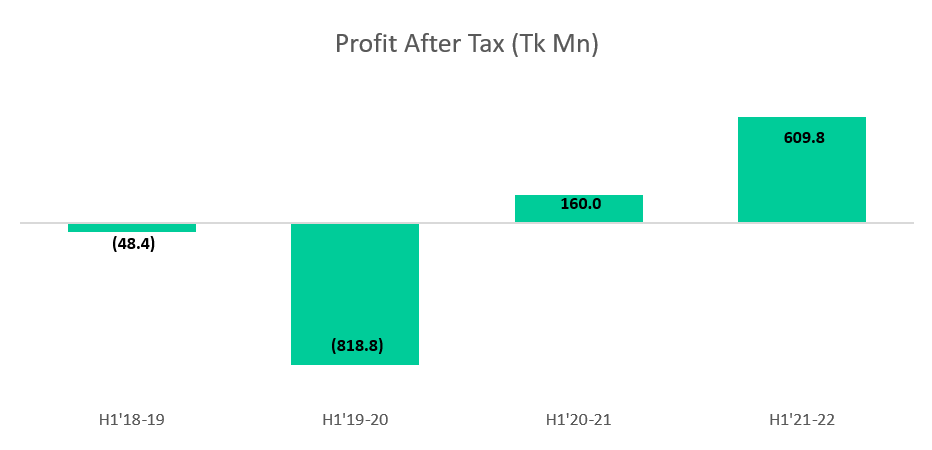

ACI Group, one of the leading local conglomerates in the country has recently posted its financial report for the period Jul’21-Dec’21. Consolidated revenue increased by 22.6% YoY from Tk 37,378.3 Mn in H1’20-21 to Tk 45,818.6 Mn in H1’21-22. Profit after tax increased by 281.1% YoY from Tk 160.0 Mn in H1’20-21 to Tk 609.8 Mn in H1’21-22.

Revenue

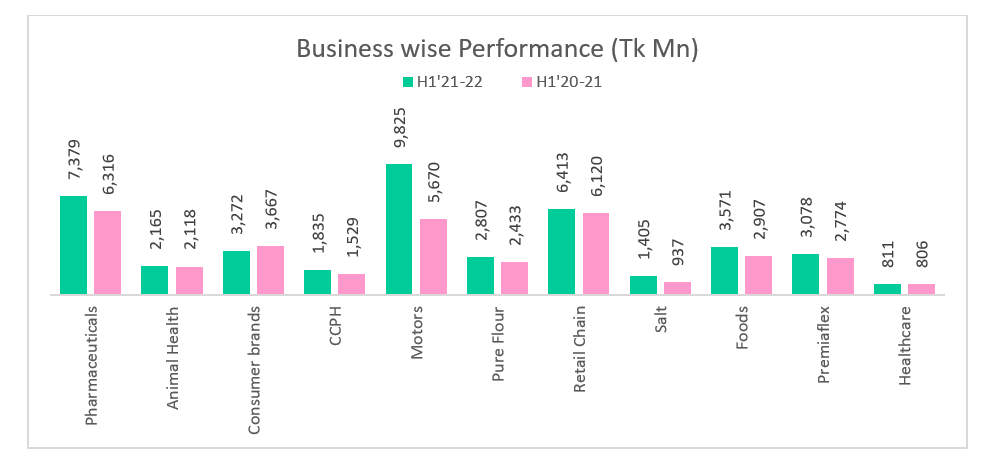

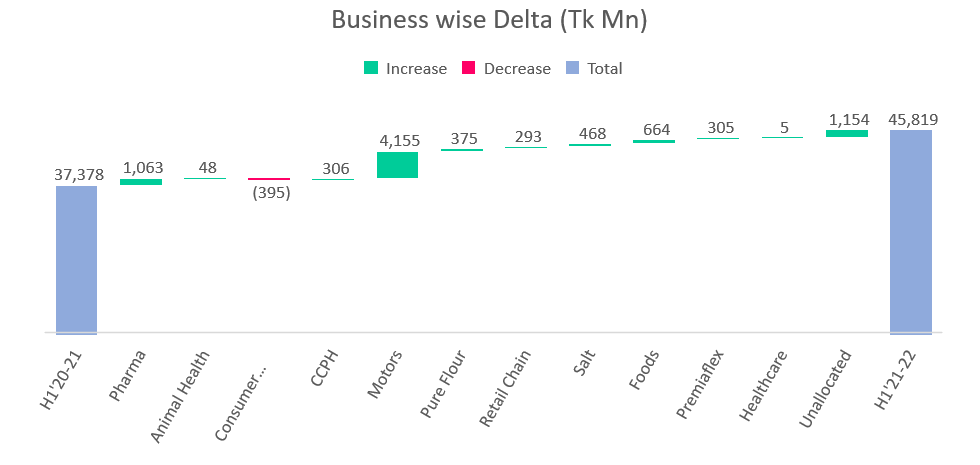

Consolidated revenue increased by Tk 8,440.3 Mn. All businesses except Consumer Brands posted growth from same period last year. Consolidated growth was mainly driven by Motors business as the segment grew by 73.3% YoY from Tk 5,670 Mn in H1’20-21 to Tk 9,825 Mn in H1’21-22. Motors business contributed to about 49.2% of the total consolidated revenue increase. Pharma business is the second biggest contributor of the overall consolidated revenue increase. Pharma Business grew by 16.8% YoY from Tk 6,316 Mn in H1’20-21 to Tk 7,379 Mn in H1’21-22. Salt and Foods business grew by 49.9% YoY and 22.8% respectively.

In terms of total revenue, Motors business is the highest contributor with 21.4% of the consolidated sales. It is followed by pharmaceuticals and retail chain business with 16.1% and 14.0% of the total sales respectively. Retails chain segment only grew by 4.8% YoY from Tk 6,120 Mn in H1’20-21 to Tk 6,413 Mn in H1’21-22.

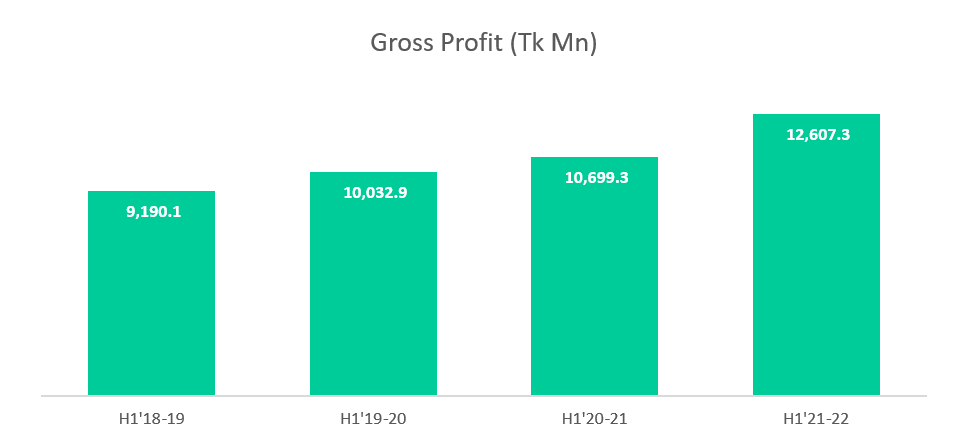

Gross Profit

Gross Profit increased by 17.8% YoY in H1’21-22 as there was a slight decrease in gross profit margin. Gross profit margin decreased from 28.6% to 27.5%. Rise of commodity prices along with freight cost may have been the primary reasons for the slight decrease in gross profit margin.

Profit

Profit increased by a staggering 281.1% YoY from Tk 160.0 Mn in H1’20-21 to Tk 609.8 Mn in H1’21-22. The increase in profit is mainly due to increase in revenue and lower OPEX to revenue percentage. OPEX only increased by 13.4% YoY whereas gross profit increased by 17.8%. As a result, operating profit increased by 28.7%. Net finance costs increased from Tk 1,793.7 Mn in H1’20-21 to Tk 1,832.5 Mn in H1’21-22.

Conclusion

ACI had a splendid H1’21-22 backed by its important pharma and motors business. As the business activities is now normal due to mass vaccination program, ACI is expected to continue to perform well in its main businesses. Net profit margin is still low at 1.3% and there is potential of improving the margins by focusing of cost controls.

For more updates, be with Markedium.

[newsletter-pack newsletter=”5159″ style=”default” si_style=”default” title=”” show_title=”0″ icon=”” heading_color=”” heading_style=”default” title_link=”” custom-css-class=”” custom-id=””][/newsletter-pack]

Leave a comment