Here’s How Marico Bangladesh Achieved 24.8% YoY Profit Growth In H1’23-242 min read

Marico Bangladesh, one of the leading FMCG companies in Bangladesh, posted a strong performance for the first half of the fiscal year 2023-24. Despite the challenging macroeconomic environment from April to September 2023, the company achieved a profit of Tk 2,497.7 million in H1’23-24.

Let’s explore how the company managed this feat.

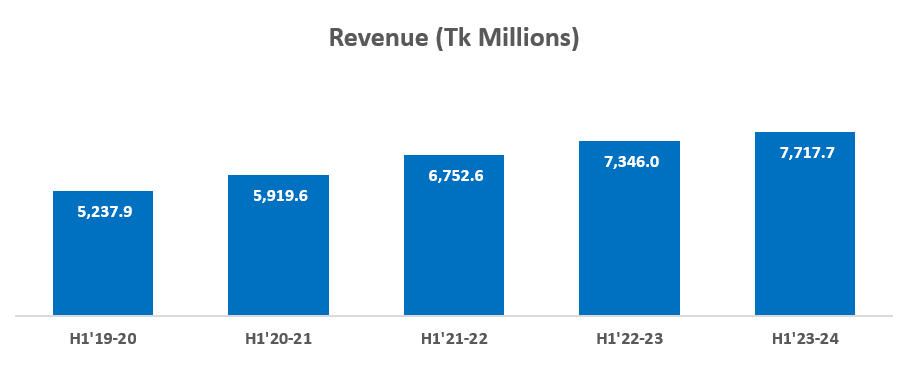

Moderate Revenue Growth

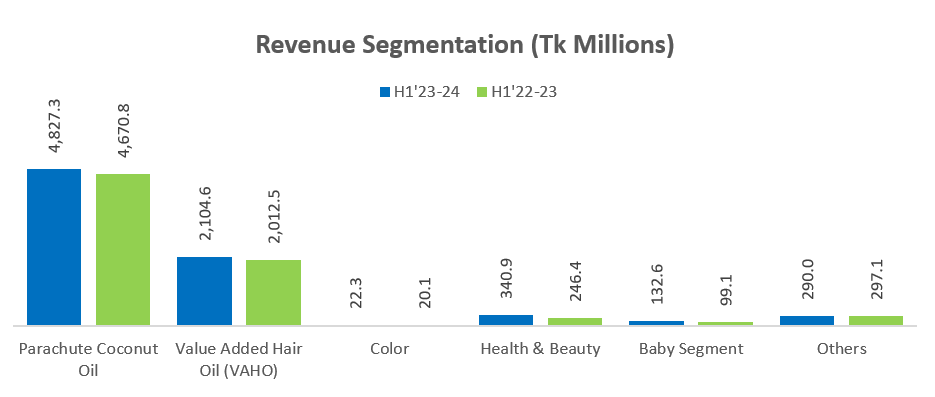

Marico experienced a moderate year-over-year (YoY) revenue growth of 5.1% in H1’23-24. Parachute Coconut Oil remained the company’s main cash cow, contributing about 62.5% to the total revenue of Tk 7,717.7 million in H1’23-24.

However, the most significant driver of revenue growth was the health & beauty segment. This segment grew by 38.3% YoY to Tk 340.9 million.

The baby segment also saw a growth of 33.8% to Tk 132.6 million. VAHO, the second-highest revenue contributor, grew by Tk 92.1 million in H1’23-24.

Read more: Here’s How bKash Achieved Major Profit Growth YoY In 9M’23

Most of the revenue growth occurred in Q1’23-24, as Marico’s revenue increased by only 1.5% YoY in Q2’23-24.

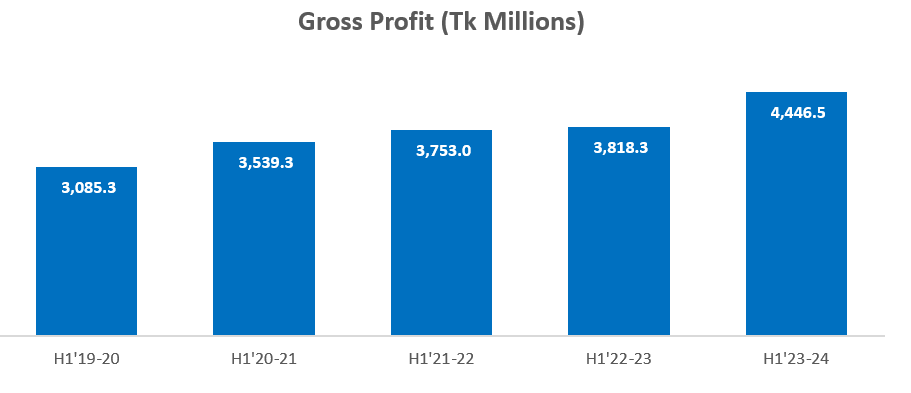

Higher Gross Profit Margin

Despite inflation and the devaluation of the dollar, Marico capitalized on the decrease in raw material prices. The gross profit margin increased by 5.6% to 57.6% in H1’23-24. This increase in margin led to a 16.5% YoY growth in gross profit.

Operational Efficiency Leading to Higher Profitability

Marico has been highly efficient in managing operational expenses, resulting in a 21.9% YoY increase in operational profit. General and Administrative expenses rose by 7.3% YoY to Tk 624.9 million in H1’23-24. Marketing, selling, and distribution expenses decreased slightly by 0.1%, despite an increase in revenue, amounting to about Tk 528.8 million.

Read more: Here’s How Robi achieved 203.1% YoY profit growth in 9M’23.

Consequently, the company posted an operational profit of Tk 3,313.3 million in H1’23-24. Additionally, significant growth in finance income was observed, driven by increasing interest rates in the market, with Marico reporting finance income of Tk 218.8 million in H1’23-24.

All these factors contributed to the company’s 24.8% YoY growth in H1’23-24, a commendable achievement considering the adverse macroeconomic conditions.

Stay tuned with Markedium for more updates.