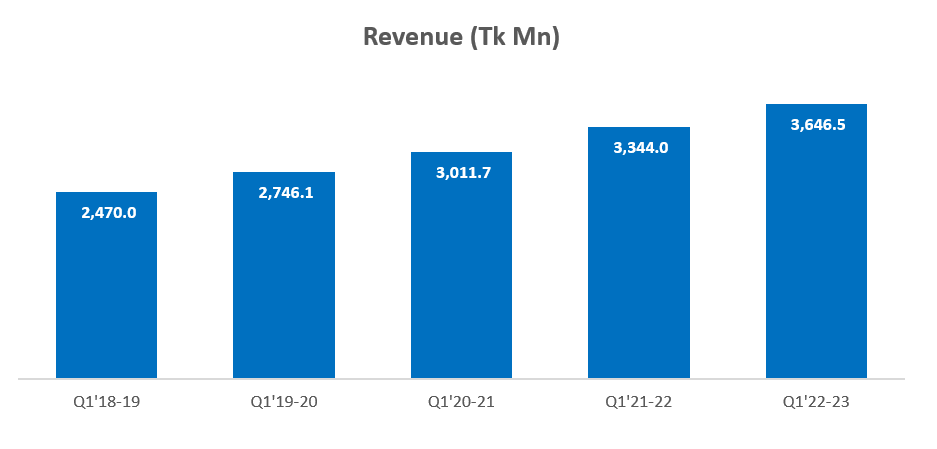

Marico Bangladesh Limited, one of the leading FMCG companies in Bangladesh has published its financial report for Q1’22-23 (Apr’22-Jun’22). Marico’s revenue increased by 9.0% YoY from Tk 3,344.0 Mn in Q1’21-22 to Tk 3,646.5 Mn in Q1’22-23. However, profit decreased by 4.7% compared to the same period last year.

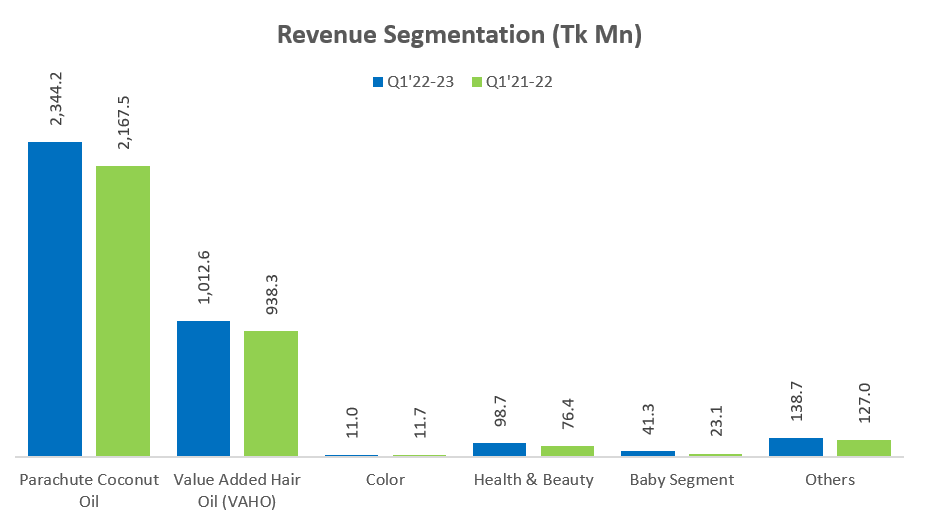

Revenue growth is driven by Parachute and VAHO segment

Revenue growth of Marico is mainly driven by 8.1% and 7.9% YoY growth in Parachute Coconut Oil and VAHO (Value Added Hair Oil) segment.

Revenue from Parachute Coconut Oil increased from Tk 2,167.5 Mn in Q1’21-22 to Tk 2,344.2 Mn in Q1’22-23. The cash cow brand now contributes about 64.3% of the total sales of Marico in Q1’22-23. Revenue from the value-added hair oil segment grew from Tk 938.3 Mn in Q1’21-22 to Tk 1,012.6 Mn in Q1’22-23. Parachute Coconut Oil and VAHO contributed 58.4% and 24.5% respectively of the Tk 302.5 Mn increase in sales. Among the six categories, only the Color segment’s revenue decreased by 5.8% compared to the same period last year.

*Others include male grooming, byproduct & others

*Others include male grooming, byproduct & others

In terms of domestic and export sales, domestic sales grew by 10.0% YoY whereas export sales declined by 52.2% YoY.

Read more: Walton Continues To Thrive In FY 21-22 Despite External Challenges

The domestic sale was Tk 3,622.1 Mn in Q1’22-23 which was Tk 3,292.6 Mn in the same period last year. Export sales decreased from Tk 51.4 Mn in Q1’21-22 to Tk 24.5 Mn in Q1’22-23.

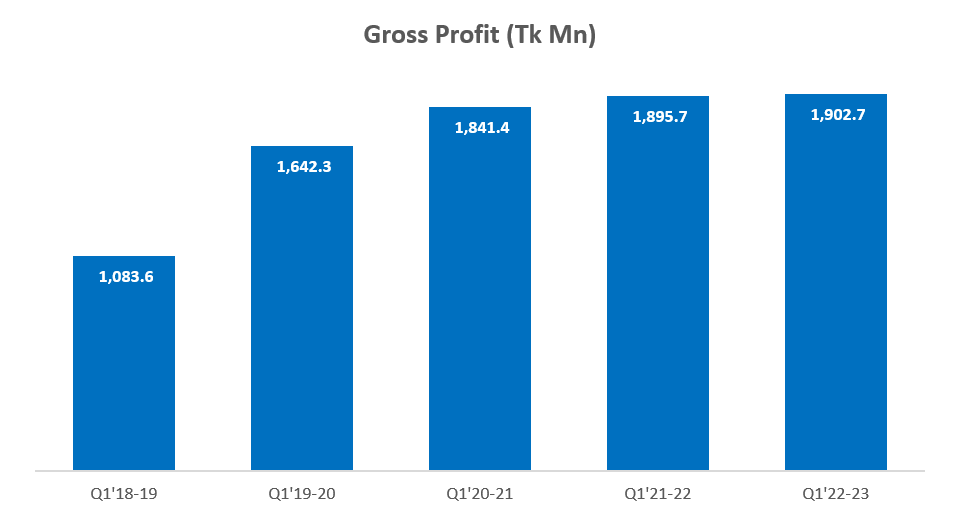

Gross Profit increased slightly due to a lower gross margin

Marico’s gross profit increased by 0.4% YoY from Tk 1,895.7 Mn in Q1’21-22 to Tk 1,902.7 Mn in Q1’22-23. Gross profit declined by 4.5% from 56.7% in Q1-21-22 to 52.2% in Q1’22-23.

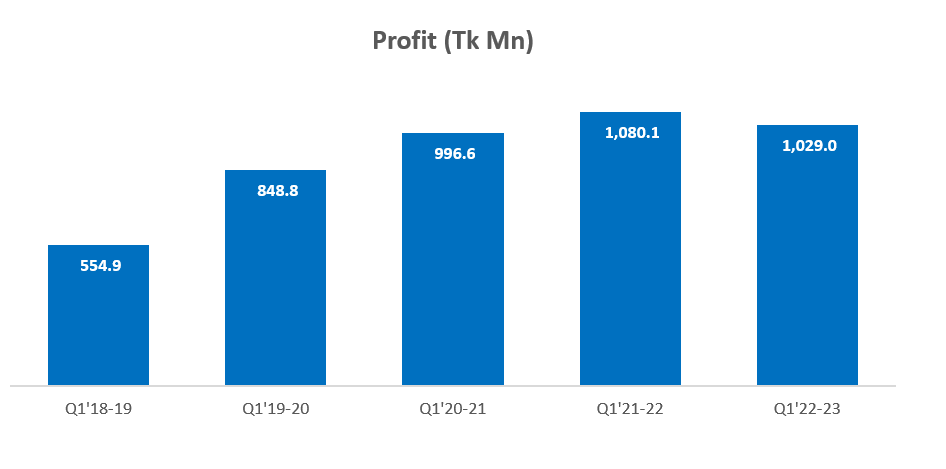

Profit decreased mainly due to higher tax expenses

The profit of Marico decreased by 4.7% YoY mainly due to higher tax expenses. Profit was Tk 1,029.0 Mn in Q1’22-23 which was Tk 1,080.1 Mn in the same period last year.

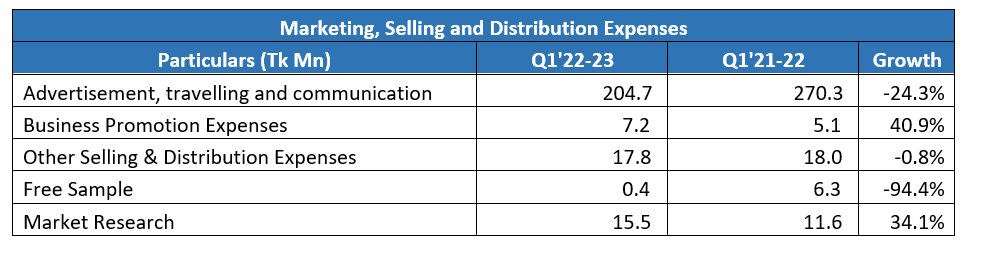

The operating profit of the company was 4.9% higher compared to the same period last year mainly due to efficient OPEX management. General and Administrative expenses only increased by 4.1% YoY whereas Marketing Selling and Distribution expenses decreased by 19.3% YoY.

The operating profit of the company was 4.9% higher compared to the same period last year mainly due to efficient OPEX management. General and Administrative expenses only increased by 4.1% YoY whereas Marketing Selling and Distribution expenses decreased by 19.3% YoY.

The company significantly decreased the advertisement, traveling, and communication by 24.3% YoY which is the main contributor to Marketing, Selling, and Distribution Expenses. Marico also decreased the free sample significantly compared to the same period last year.

The company significantly decreased the advertisement, traveling, and communication by 24.3% YoY which is the main contributor to Marketing, Selling, and Distribution Expenses. Marico also decreased the free sample significantly compared to the same period last year.

Marico might face more pressure on profitability due to Macroeconomic challenges

The current macroeconomic scenario might put further pressure on gross profit margin in the coming quarter. Raw material prices are increasing mainly due to currency devaluation and higher commodity prices. Currency devaluation of the Taka against foreign currencies needs to become stable in order to maintain past gross profit margin.

For more updates, be with Markedium.

Leave a comment