City Bank PLC pioneered digital banking in Bangladesh with the introduction of the Citytouch app. Committed to enhancing customer convenience, Citytouch has become one of the premier digital banking platforms in the country. Positioned at the heart of City Bank’s digital strategy, alongside products like Nano Loans and Digital Islamic DPS, Citytouch exemplifies the bank’s vision of “Banking without going to the Bank.”

Originally featuring capabilities such as opening FD and DPS accounts, paying credit card and utility bills, shopping at well-known stores, and monitoring various financial accounts, the app expanded its offerings in 2023 with new features to further streamline and enrich user experience.

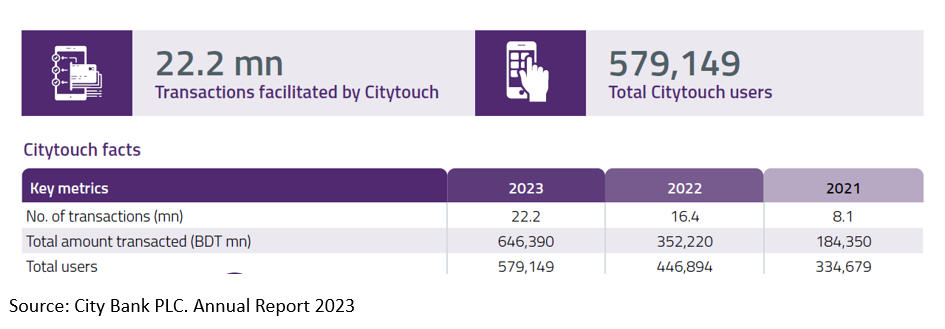

The City Bank PLC Annual Report 2023 highlights the impressive growth of their digital banking platform, Citytouch. Over the past three years, Citytouch has seen a significant increase in usage, with the number of transactions skyrocketing from 8.1 million in 2021 to 22.2 million in 2023. The total amount transacted also surged, reaching 646,390 million BDT in 2023, a substantial rise from 184,350 million BDT in 2021.

Additionally, the user base expanded remarkably, growing from 334,679 users in 2021 to 579,149 users in 2023. These metrics reflect Citytouch’s success in enhancing its digital services and the growing customer trust in its platform.

The report also showed that in 2020, transactions amounted to 81,719 million BDT, which more than doubled to 184,350 million BDT in 2021. This upward trend continued, with transactions reaching 352,220 million BDT in 2022 and an impressive 646,386 million BDT in 2023. This significant growth reflects City Bank’s success in promoting Citytouch as a preferred digital banking platform, highlighting its effectiveness and increasing customer adoption.

Read more: Wind App Founder Elius in Tatler Asia’s ‘Leaders of Tomorrow’

In 2023, a notable advancement was the introduction of Bangladesh’s first virtual debit and prepaid card product by City Bank, in collaboration with leading global payment networks including American Express, Visa, MasterCard, and UnionPay. This innovation allows City Bank customers to instantly obtain a virtual debit card through the Citytouch app, offering all the advantages of a traditional debit card without the need to visit a bank branch.

Additionally, Citytouch enhanced its utility bill payment services by adding 11 new features. The app now supports Bangla QR payments, broadening its payment capabilities. Further expanding its services, Citytouch has bolstered its wealth management features in partnership with City Brokerage. Customers can now open BO accounts and engage with the capital market directly through the Citytouch app, facilitated by City Brokerage.

For more updates, be with Markedium.

Leave a comment