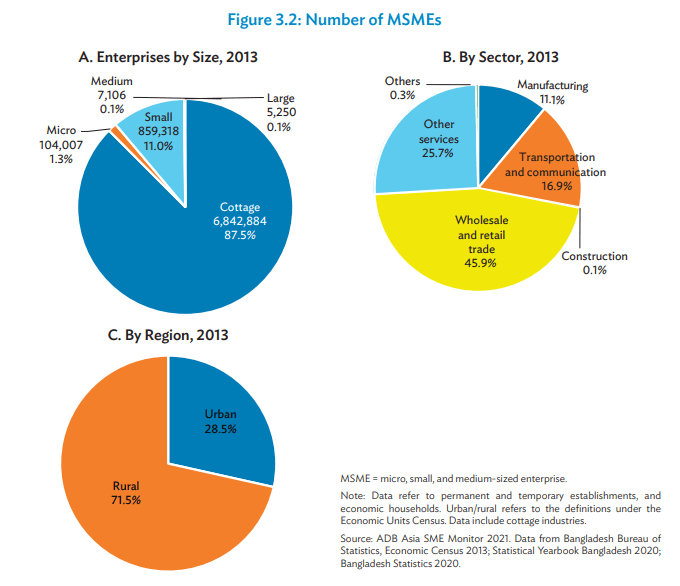

SMEs (Small and medium-sized enterprises) are often addressed as the drivers of stability and resilience for a nation. Even for a densely populated country like Bangladesh, SMEs create multidimensional opportunities as they are not limited to some specific sectors. According to a 2021 report by ADB, SMEs account for 99.97% of all Asian businesses. Particularly for Bangladesh, the estimation stands for 7.8 million MSMEs (including cottage), accounting for over 97% of all enterprises in Bangladesh. This shows that SMEs have massive potential for the country’s socio-economic development. In addition, the record indicates that SMEs are growing at around 6% or more annually. This shows a promising future in the SME landscape of Bangladesh.

From the beginning, SMEs are creating job opportunities with invention and innovation in business ideas. Such ideas are helping the economy to explore different sectors and tap into the underutilized resources. Even though SMEs are being titled as the engine of growth for Bangladesh’s economy, several challenges exist for SME founders.

Improper Business Plan

Banks often seem reluctant to finance SMEs because of incomplete documentation and improper business plans. The latter component does not particularly mean that the business plan is insufficient. Instead, it indicates that following a structure while applying for bank financing opportunities would increase the possibility. For example: as per the SME Foundation website (http://www.smef.gov.bd/), there is an SME Business Manual that is aimed at helping the SME founders to check all the boxes on the list to ensure the feasibility of the business. Not every point has to be met; however, encountering a maximum number of requirements sets the idea as visionary and shows the long-term prospects.

Inaccessibility to Affordable Finance

The lack of showing sustainability in the business idea often fails to capture the future implications. As per some estimations, SME founders rely on traders, loan sharks, friends and family, and microfinance institutions where the rate of interest is comparatively very high, such as 30%-40% (Future Startup, 2022). Even though the policy initiatives have eased the ways for SME loans, it still is out of reach for a more significant number of SME founders. On the other hand, SME founders find it difficult to deal with the structured process of the bank branches.

Supply chain financing- a comparatively new concept, has emerged as a solution for this financing dilemma for SME businesses in Bangladesh. Through the financial solution, SMEs can receive early payments on their invoices. Supply chain finance allows SMEs to optimize both parties’ working capital and liquidity.

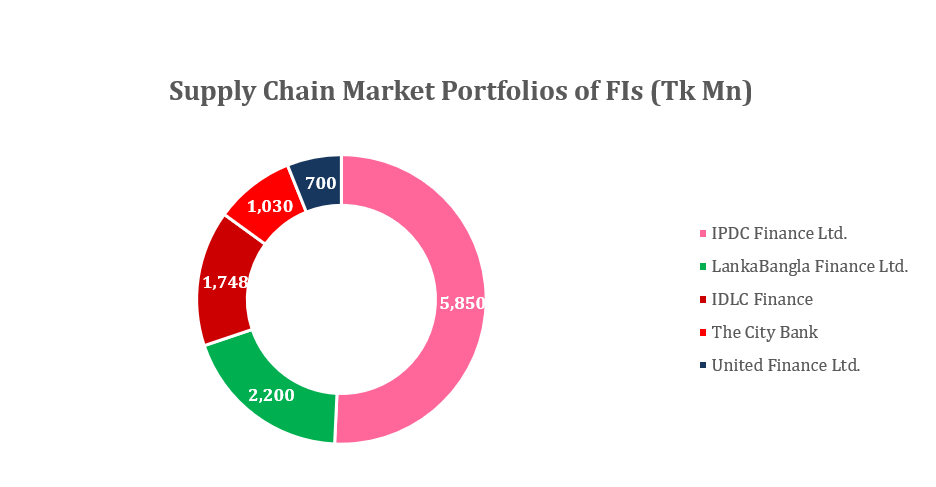

According to IDLC Monthly Business Review, the total market size of the supply chain finance market is approximately Tk 4,000 crore, including the banks and NBFIs.

IDLC Finance Ltd first introduced supply chain finance in 1999. Then in 2006, United Finance and LankaBangla Finance Limited entered the market. IDPC Finance entered the supply chain market late but is now the market leader in this segment.

Lack of training resulting in the absence of an unskilled workforce

Training help in people’s development process where they can learn more and grow as per the business goal. However, the lack of proper training can result in ambiguity in achieving the purpose of the business. This is where the SME founders face the challenge of assessing the needs of the people in terms of training them. As there is a lack of funding in the first place, it becomes even more challenging to provide the training for the specialized areas.

Poor infrastructure

Simply put, the uninterrupted power and gas supply can be considered one of the crucial factors that could increase productivity. However, such infrastructure deficiencies can result in significant losses, which alternatives may not back up. It indeed becomes challenging to have the back-up for the SME founders when they struggle to find finance in the primary functioning areas.

Compliance Issues

It is widely seen that SME founders often seem to face challenges in interpreting the policies associated with the SMEs. Even though the last few years have seen some positive changes, it still is not enough to create awareness among SME founders. The lack of knowledge makes making the business idea sustainable even more challenging as it raises the question of compliance issues and such.

Inadequate Technology and Capital

Undoubtedly the world is moving at a faster pace which includes technological advancements. Following the age-old practices does not help a new business to flourish as it does not create many opportunities to explore. With the lack of capital invested in the technological sector, it becomes even more difficult for the SME founder to create a unique selling proposition for the business.

Unstable Policies

The lack of knowledge in understanding the policies themselves is a barrier to formalizing the whole business idea. Suppose the instability in the guidelines is added in such a situation. In that case, it gets more challenging for the SME founder to adhere to the updated policies.

Even though SMEs are considered an integral part of Bangladesh’s economy, the SME founders have to face many challenges in implementing their ideas in the market. Even after the challenges, notable success stories inspire the dreamers to make their ideas sustainable. Suppose there are more opportunities for cheaper working capital, collaboration, and connection with different endpoints. In that case, such dreams will transform into action creating thousands of new jobs for the people.

For more updates, be with Markedium.

Leave a comment