Would Implementing Additional Taxes on High Sugar Products Benefit Bangladesh?5 min read

In Bangladesh, the momentum in revenue collection has been persistently sluggish due to widespread tax evasion among corporations and industries. Despite efforts, the National Board of Revenue (NBR) is expected to cover only 56.4% of the annual national budget for the fiscal year 2023-24 through taxes.

This reliance on tax revenue is crucial for the country’s economic advancement plans. However, the prevalence of tax evasion, coupled with preferential tax rates for certain industries and products, poses a significant threat to revenue collection.

The Center for Policy Dialogue (CPD) has sounded alarms, projecting a looming shortfall of BDT 82 thousand crores by the fiscal year’s end in 2023-24. This deficit could disrupt Bangladesh’s economic trajectory, hindering its developmental goals.

During the first five months (July-November) of the fiscal year 2023-24, total revenue collection reportedly amounted to BDT 1,32,334 crores, falling short of the target of BDT 1,48,794 crores by a significant deficit of BDT 16,459 crores. The outlook for the remaining months does not offer much promise of improvement. To bridge this gap and align with the target, the National Board of Revenue (NBR) may need to scrutinize industries that are currently not under significant tax burdens or those operating with thin profit margins.

One such industry could be the market for sugar-based consumer goods like cakes, chocolates, juices, and biscuits which is expanding in Bangladesh. However, the local sugary foods industry is subject to only 5-15% VAT, with no Supplementary Duty (SD) imposed on any other sugar-based local products except for ice cream.

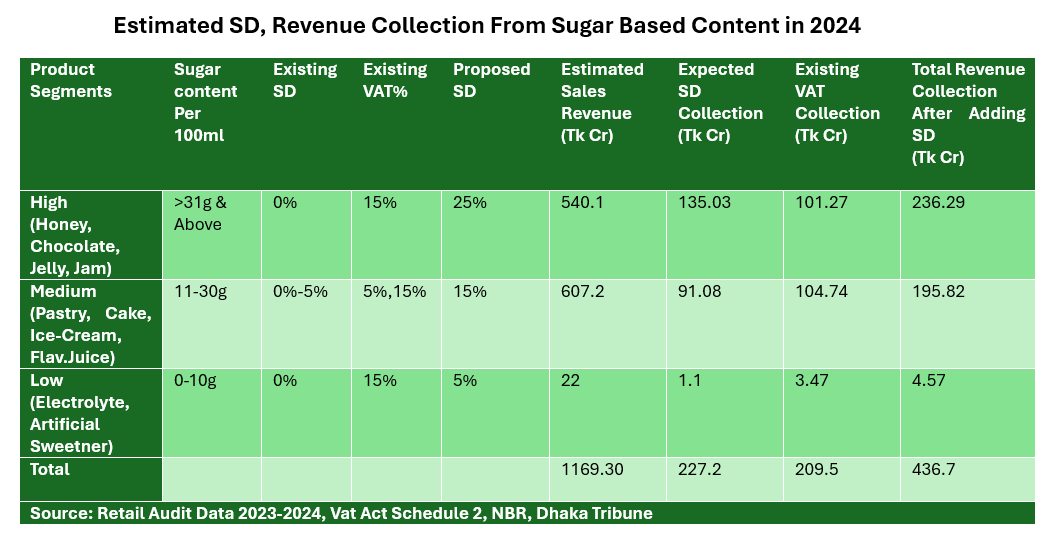

Based on retail audit data for the fiscal year 2023-24, the government has the potential to generate an additional Tk227.2 crore in revenue from various sugar-based industries, including cakes, biscuits, ice cream, candies, and juices.

In 2024, sugar-based industries, excluding the beverage sector, are projected to yield an estimated sales revenue of Tk1169.30 crore.

Customs reports indicate that the beverage, pharmaceutical, and beauty care industries collectively utilize less than 4% of the total imported sugar. The majority, over 90%, is reportedly consumed by confectionery, juice, condensed milk, and candy manufacturers, with the remainder entering the open market for daily consumption.

According to customs declarations, only a select few industries utilize refined sugar as raw material in their production processes, while the majority procure sugar from open markets without a formal declaration.

A noticeable disparity exists, as numerous sugar-based industries and products containing varying amounts of sugar, ranging from 0 to over 31 grams per 100ml, are subject to minimal or no Supplementary Duty (SD), except for ice cream, which incurs a 5% SD.

Another key note to address here is that a visible amount of sugar content can be identified as non-essential and in essence, Supplementary Duty (SD) is levied on luxury items, non-essential goods, and products deemed unhealthy, aiming to discourage their consumption.

Read more: Samsung’s Profits Surge 930% on AI-Driven Memory Chip Demand

And, it is needless to say that, excessive sugar intake can lead to a condition known as insulin resistance, which serves as a precursor to type 2 diabetes, fatty liver disease, and cardiovascular issues. Insulin plays a crucial role in facilitating the body’s absorption of glucose, or sugar, for energy. Individuals with insulin resistance encounter a buildup of glucose in their bloodstream, according to medical experts.

Hence, there arises a debate regarding the necessity for stringent policy enforcement at the sugar import level, including the imposition of taxes at the source to prevent potential revenue leakages. Such measures could also facilitate the restructuring of tax formats which might eventually help Bangladesh to reduce some of the deficits in revenue collection.

Sugar Import Recent Industry Outlook

Reportedly, Bangladesh’s monthly demand for sugar was estimated to be around 1.5 lakh tons, with a notable surge of at least 50% during the summer and the holy month of Ramadan.

For the first 8 months of FY24 (until February), the country witnessed the entry of 9,82,000 tons of commercially imported sugar through sea and land ports, with a Customs Duty value totaling BDT 6,385 crores. The National Board of Revenue (NBR) anticipates a total import of around 14,73,000 tons of sugar throughout FY2023-24, primarily facilitated by 5-7 companies.

The substantial volume of imported sugar serves as a primary ingredient in the production of various consumer goods such as juice, ice cream, chocolates, cakes, biscuits, jam, jelly, and spreads, none of which currently incur supplementary duty.

Concerns have been raised regarding alleged duty evasion within the industry, particularly regarding the lower taxation on refined sugar compared to raw or unrefined sugar.

The Bangladesh Trade and Tariff Commission has reported an annual consumption demand for sugar in Bangladesh ranging from 2 to 2.2 million tons. The country annually imports approximately 2.2-2.4 million tons of raw sugar and nearly 50 thousand tons of refined sugar.

Speculation surrounds a $100 price difference between refined and raw sugar in the global market, with refined sugar facing lower taxation than unrefined sugar at customs points. Stakeholders propose revitalizing sugar mills to make sugarcane farming profitable, alongside extending tax incentives to prospective industries for economic growth.

Disparities exist in the taxation of sugar-based products domestically, prompting suggestions to classify Supplementary Duty (SD) based on sugar content. Implementation of this system could potentially increase government revenue to Tk436.68 crore annually. However, a warning from the Center for Policy Dialogue (CPD) highlights an anticipated Tk82,000 crore shortfall by FY 2023-24’s end. With 56.4% of the annual national budget reliant on National Board of Revenue (NBR) taxes, the deficit of Tk16,459 crores in revenue collection within the first 5 months poses significant challenges.

For more updates, be with Markedium.