Starbucks, the renowned coffeehouse chain, has managed to amass a staggering $1.8 billion in customer funds through its rewards program as of April 2. To put this in perspective, if Starbucks were classified as a bank, it would surpass 90% of the banks overseen by the US FDIC in terms of deposit size.

How is Starbucks a Bank?

Starbucks holds $1.85 billion in customer deposits as of 2025. That’s more than 85% of U.S. banks hold in total assets. Yet Starbucks pays zero interest, faces no banking regulations, and never has to return deposits as cash—only coffee.

Here’s how a coffee chain became a financial powerhouse disguised as a loyalty program.

The Foundation: Turning Gift Cards Into Deposits

The journey began in 2001 when Starbucks introduced the Starbucks Card. This card, initially a prototype for employees, soon became a public sensation. Within its debut year, users deposited over $2.4 billion—not for banking services, but for convenient coffee purchases.

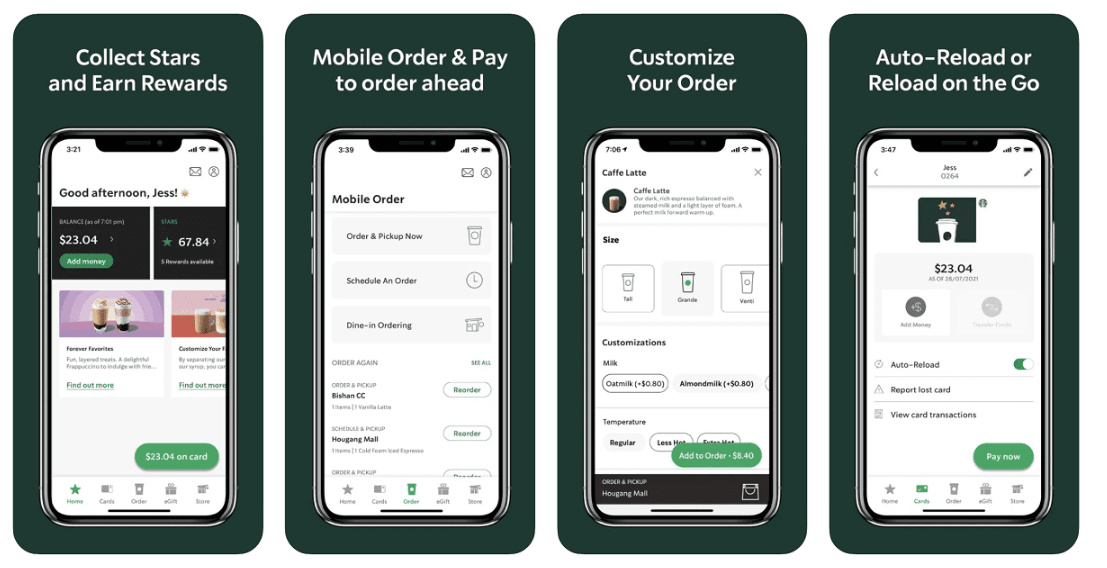

As the years progressed, this card transformed into the Starbucks Gold Card, offering exclusive benefits that turned casual customers into repeat depositors. By 2009, the brand consolidated its card initiatives into “My Starbucks Rewards,” accompanied by a mobile app that made payment a seamless, addictive experience.

Building the Banking Infrastructure

Starbucks didn’t stop at digital wallets. They built a genuine financial infrastructure by partnering with payment giants. In 2012, they invested $25 million in Square to streamline mobile payments. Later, they collaborated with J.P. Morgan’s Chase Commerce Solutions for payment processing and introduced “Starbucks Pickup with Amazon Go,” allowing pre-paid orders without traditional checkouts.

Internationally, Starbucks expanded its financial footprint. In the UK, they partnered with Barclaycard for contactless payments. In Japan, they launched an NFC-enabled pen for instant payments. In the Middle East, they promoted Apple Pay with Visa. Their global reach extended through partnerships with Grab in Southeast Asia and MoMo e-wallet in Vietnam.

Starbucks even tested the cryptocurrency waters, partnering with Microsoft in 2018 to accept crypto payments and, by 2021, facilitating Bitcoin transactions through the Bakkt wallet. Despite openiing up for cryptocurrency, Starbucks

The Brilliant Business Model

As of 2025, the Starbucks app has 31 million active users—essentially 31 million people making interest-free deposits. Customers load funds using gift cards, Apple Pay, or credit cards, then earn loyalty “Stars” when purchasing with stored balances. The app defaults to $25 reloads with $10-15 minimums, a design choice that quietly maximizes deposits.

The real genius? Starbucks earns money three ways banks can’t:

Breakage revenue

In 2024 alone, Starbucks recognized $207 million in revenue from unused gift cards and loyalty balances—money customers deposited but never reclaimed.

Float income

That $1.85 billion sits in Starbucks accounts, earning returns through money market funds and short-term investments while customers slowly redeem balances over weeks or months.

Increased spending

Rewards members account for over 40% of U.S. store revenue and spend significantly more per visit than non-members, driven by the psychology of “play money” already loaded into accounts.

Why This Banking Model Works

You don’t think twice about loading $25 into your Starbucks app. But you just made an interest-free loan to a corporation that will use that money immediately for operations, expansion, and investments. You can’t withdraw it as cash. You can’t earn interest on it. And statistically, you probably won’t use all of it.

Meanwhile, Starbucks operates with nearly $2 billion in customer funds without regulatory oversight, reserve requirements, or deposit insurance obligations that actual banks face.

That’s not a loyalty program—that’s a neobank with a coffee shop attached.

Leave a comment