Listed companies in Bangladesh experienced a significant 24% profits decline, year-on-year during January to September 2024, driven by an economic slowdown and widespread political instability, according to an estimate by Shanta Securities. The leading brokerage firm’s report, titled “Bangladesh Finds its Lighthouse Amid Reform Hopes,” highlights the severe financial strain across sectors, with the paper, printing and ceramic industries suffering the most, reporting a staggering 149% decline in earnings during the first three quarters of 2024, stated in a report.

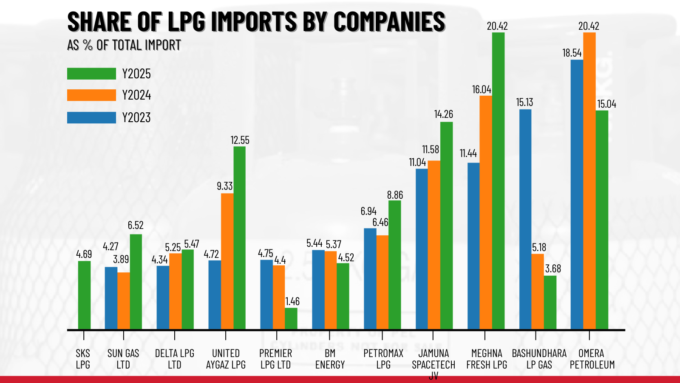

The report also detailed substantial losses in other key sectors. Textile and tannery profits fell by over 70%, the fuel and power sector by 62%, the engineering sector by 42%, and the banking sector by 17%. Shanta Securities attributed these declines not only to political turmoil and an economic slowdown but also to rising bank loan interest rates and escalating raw material costs.

The textile sector faced diminished export orders, while the banking sector grappled with higher provisioning requirements, both contributing to declining profits. Business activities slowed dramatically after mid-July as the quota reform movement swept through the country, triggering widespread disruptions. The situation deteriorated further following government crackdowns, army deployment, and curfews, culminating in the ouster of the government in early August through a mass uprising.

Read more: Direct Tax Expenditure Drops To Tk 1.15 Lakh Crore In FY22

With the interim government assuming office, the report noted a gradual improvement in the business climate. However, economic activities remained subdued, falling short of pre-July 2024 levels due to business caution and lingering uncertainties.

Domestically, the report identified inflation control, meeting revenue targets, and stabilizing the banking sector as critical challenges. Persistent inflation, fueled by the taka’s depreciation and local supply chain inefficiencies, remained a pressing concern. Despite five policy rate hikes by Bangladesh Bank in 2024, raising rates to 10%, inflation showed little improvement, further straining the business environment.

The banking sector also faced mounting risks, with non-performing loans reaching 16.9% by September 2024. Several banks defaulted on depositor payments, raising alarms about potential economic repercussions if these issues are not addressed effectively.

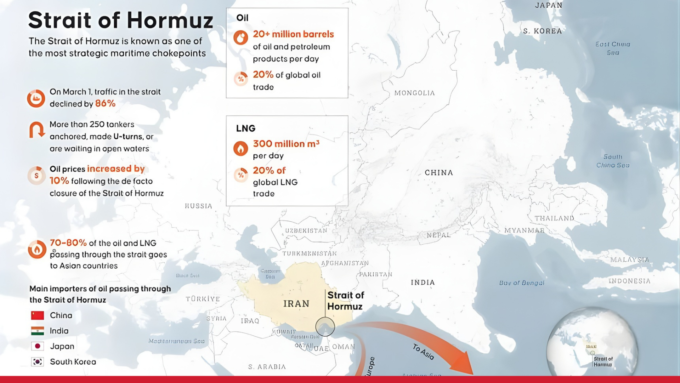

The report emphasized that regaining economic momentum and creating a stable business environment will be the primary challenges in 2025. Political stability, banking sector resilience, and effective management of price pressures and exchange rate volatility will be crucial. Additionally, geopolitical uncertainties, such as the US stance on the Russia-Ukraine conflict and the Myanmar crisis, add to the risks.

The stock market remained bearish throughout 2024, with speculative trading dominating amid high interest rates. A brief rally in large-cap stocks following the August political transition failed to sustain as concerns over economic policies dampened investor confidence. Regulatory and economic reforms in the final quarter of 2024 also influenced market behavior.

Shanta Securities predicts a market recovery in mid-2025, driven by declining inflation and interest rates. The report anticipates improved investor sentiment and increased trading activity, particularly in large-cap stocks, during the year’s second half.

Mohammad Lutfor Rahman, an economics professor at Jahangirnagar University, stated that the profit declines were unsurprising given the prolonged business suspension during political unrest. Fluctuating foreign exchange rates, rising financing costs, and higher operational expenses due to elevated energy prices compounded the challenges.

Rahman highlighted the energy supply crisis as a critical constraint, particularly for the textile sector, which struggled with low gas pressure and reduced production capacity. Despite these challenges, he expressed optimism about a global economic recovery, fueled by de-escalation in the Russia-Ukraine conflict and stabilizing oil prices. However, Rahman cautioned that frequent political unrest poses a significant hurdle for Bangladesh in capitalizing on global recovery trends.

The path to economic recovery in 2025 remains fraught with challenges, but with strategic reforms and political stability, the report suggests that a turnaround is within reach.

For more updates, be with Markedium.

Leave a comment