Gold has shattered records, soaring past the $3,000 per ounce mark for the first time as economic turmoil and escalating trade tensions send investors rushing toward the safe-haven asset. On Friday, prices peaked at $3,004.86 per ounce, marking a 14% surge since the start of 2025, reportedly.

Gold has long been a refuge in times of uncertainty, and the intensifying US trade war with key global partners has rattled financial markets, fueling demand for the metal. The latest wave of tariffs has sparked fears of rising inflation, making gold an attractive hedge against economic instability.

- US President Donald Trump has threatened a 200% tariff on European alcohol imports, retaliating against the EU’s planned 50% tax on American whiskey – the latest tit-for-tat in the trade battle.

- Trump has also raised levies on Chinese imports to at least 20%, further stoking tensions.

Tariffs increase costs for businesses, which could lead to higher prices for consumers – a scenario that often drives investors toward gold as a hedge against inflation.

Read more: Gold, A Rising Investment Amid Economic Turbulence

Victoria Hasler, head of fund research at Hargreaves Lansdown, highlights two key drivers behind gold’s meteoric rise:

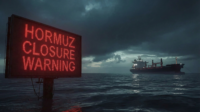

- Uncertainty & Market Volatility – The US trade war, coupled with rising geopolitical tensions in the Middle East and Russia-Ukraine, has heightened uncertainty, pushing investors toward safe-haven assets.

- Central Bank Buying Frenzy – Global central banks have been aggressively accumulating gold, adding 1,045 tonnes to their reserves last year, according to World Gold Council data.

Russ Mould, investment director at AJ Bell, notes that gold has been on an unstoppable climb since 2018, when it dipped below $1,200 an ounce. Factors like the Covid pandemic, ballooning government deficits, and economic crises have consistently driven investors back to gold – cementing its reputation as the ultimate financial safeguard.

With no end in sight for trade disputes and economic instability, could gold break even higher records in the months ahead?

For more updates, be with Markedium.

Leave a comment