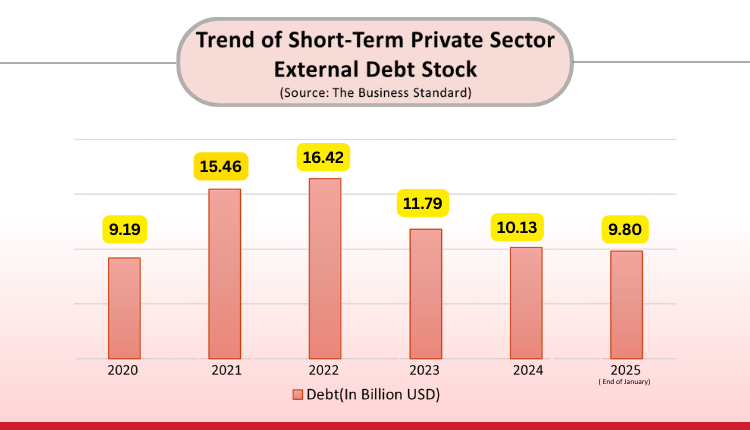

The outstanding short-term foreign debt of Bangladesh’s private sector has reportedly fallen below $10 billion for the first time in nearly four years, according to central bank data. As of January 2025, the debt stood at $9.8 billion, down from a peak of $16.42 billion in December 2022. The last time the outstanding debt was lower was in December 2020, when it amounted to $9.2 billion.

Since then, the private sector’s short-term foreign debt had been steadily increasing, reaching $15.46 billion by the end of 2021, a rise of approximately $6 billion within just a year. Senior bankers attribute the recent decline to several factors, including exchange rate volatility, a decline in the country’s credit rating, and reductions in the short-term loan limits by foreign banks. These developments, alongside a consistent decline in the country’s reserves, have contributed to a trust deficit among foreign clients and banks regarding Bangladesh.

The downgrade of Bangladesh’s credit rating by several international agencies has further deepened this lack of confidence, exacerbating the decline in the private sector’s short-term foreign debt. Data from the central bank reveals that the outstanding debt has been decreasing almost every month since December 2022. From January to March 2023 alone, the outstanding debt decreased by $2.3 billion. As of January 2024, the outstanding debt had dropped by approximately $1.45 billion compared to the same period in the previous year.

Read more: Government Releases Tk 525 Crore To Settle Beximco Workers Dues

A deputy managing director at a leading private bank stated that the reduction in credit limits from foreign suppliers has made it difficult to open large volumes of deferred letters of credit (LCs) as before. Additionally, uncertainty regarding the exchange rate has led to a slight decline in the demand for deferred LCs among importers.

Despite the gains in interest rates, senior bankers explained that the interest rate on foreign loans currently stands at around 8%, after adding a premium to the SOFR (Secured Overnight Financing Rate). In contrast, local currency loans carry an interest rate of around 12%, offering a gain of approximately 4% for foreign loans. However, due to the volatility in exchange rates, many customers have become less inclined to take advantage of this benefit.

According to central bank data, the outstanding deferred payment debt stood at $643 million at the end of January 2025, a decline from $972 million a year earlier. The most significant drop in short-term foreign debt has been in buyer’s credit, which fell from $5.97 billion in January 2024 to $5.08 billion by January 2025, a decrease of roughly $900 million over the year.

Typically, Bangladeshi exporters take loans against future export orders from their buyers. However, bankers report that many buyers are no longer providing long-term loans, with loan tenures reduced from one year to six months. A managing director from another private bank remarked that many banks now face reduced capacity to open UPAS (Usance Payable at Sight) LCs and facilitate buyer’s credit for their clients. Foreign banks have also lowered credit limits for Bangladeshi banks, and some are even avoiding loan exposure to local banks, further contributing to the decline in buyer’s credit.

A similar trend is being observed with short-term loans, which have decreased by approximately $750 million over the past year, reaching $2.05 billion by the end of January 2025. Bankers attribute this decline to foreign banks reducing short-term loan disbursements.

However, the central bank’s data shows that back-to-back LCs have increased by approximately $340 million over the past year, driven by strong export growth. Sohail RK Hussain, the managing director of Bank Asia, explained that importers are increasingly focusing on opening sight LCs instead of deferred LCs due to exchange rate risks and the need to pay confirmation charges for deferred LCs.

Despite some relief from declining international interest rates, Sohail noted that the private sector’s short-term foreign debt is unlikely to see significant changes in the next 4-5 months. The central bank’s data also shows that Bangladesh’s forex reserves remained steady, standing at $19.96 billion at the end of January 2024 and maintaining the same level by the end of January 2025.

Sohail remains optimistic about remittance growth and the country’s strong export performance, which could ease pressure on the exchange rate. However, he indicated that the continuation of the decline in short-term foreign debt is expected unless there is a major shift in the foreign exchange market.

For more updates, be with Markedium.

Leave a comment